It depends. If your merely money into your checking account is actually out of head-deposited societal security or even the Veteran’s Administration (VA), essentially payday loans Gardner a view creditor do not garnish the new membership. Money from those people present is exempt from range.

In the event a collector have not prosecuted your, in the event your money was exempt, you should be careful to keep a pay check lender of taking over it. In case your pay check lender keeps the inspections, otherwise authorization to view your account, it does not must sue you to receive payment.

You might have to personal brand new account and you will flow your bank account in order to a free account at another bank. Specific banking companies cannot unlock an alternate make up your in the event the you borrowed a separate financial.

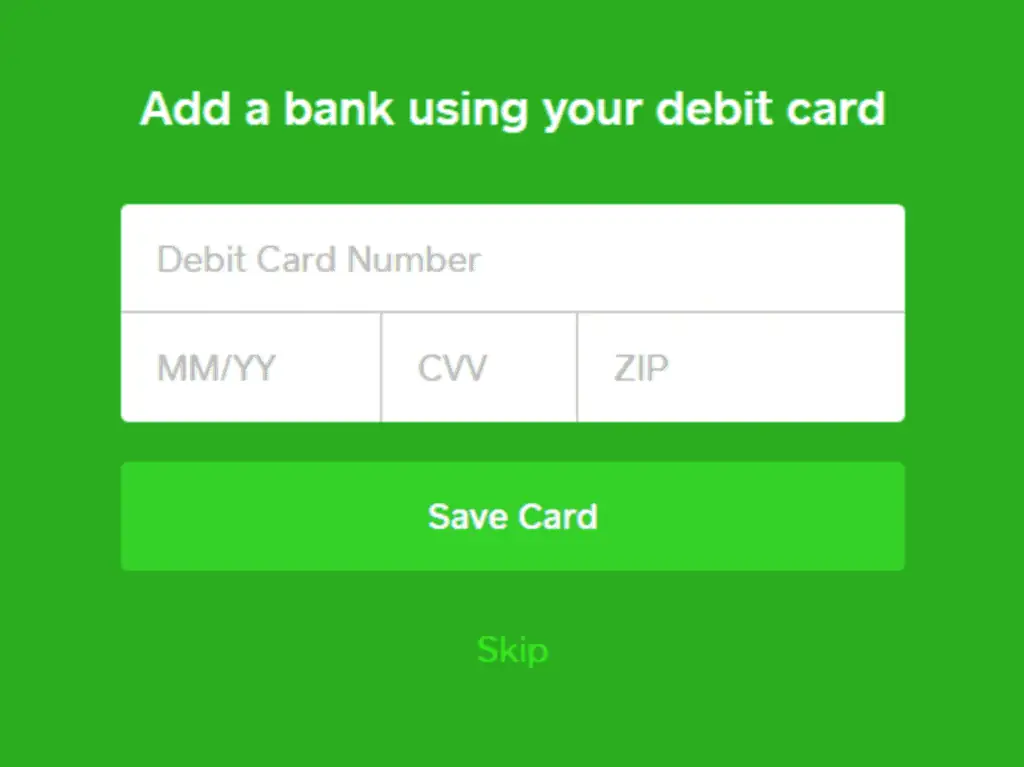

When you yourself have your social protection gurus otherwise Virtual assistant repayments head placed to the a checking account one a pay check bank provides your consent to get into (throughout your check otherwise authorization), you could redirect where the automatic dumps are produced. Read more about changing automated dumps away from social safeguards benefits on . End people financial who desires one to have your social safety monitors transferred directly into a bank checking account the lender controls.

Do not commingle (mix) nonexempt funds with your social security and VA money. Example: You deposit a birthday check from a family member into the same account as your exempt social security funds.

If the creditor sues your, you ought to answer the latest lawsuit and you can any garnishment find because of the alerting every functions on paper that they cannot garnish your money because it keeps simply excused loans.

Can the lending company jeopardize me that have unlawful charges?

Zero. It is unlawful for a pay-day bank to help you threaten in order to toss your inside the jail or perhaps to prosecute you criminally to possess a delinquent financial obligation. In such a circumstance, you should instantaneously file a criticism with DFI. You can even complain to DFI if the payday lenders try harassing your by calling your property or functions more than a few times 24 hours, showing up working, conversing with your family in regards to the financial obligation, and the like.

Fundamentally, when gathering otherwise looking to assemble a payday loan, the lending company will most likely not harass or intimidate your. The financial institution never:

If you were to think a payday bank have harassed your if you find yourself trying to gather on the financing, contact DFI to help you file a grievance. See lower than.

I am an army debtor. What are my personal rights?

Federal laws restrictions to thirty-six% the fresh new ilies toward payday, taxation refund expectation, and you may vehicles label fund. Loan providers dont accept checks otherwise agreement so you can withdraw money from good military family’s savings account just like the security for a loan.

We got aside an instant payday loan on line. The lending company is actually billing a high rate than simply county legislation lets. Exactly what can I actually do?

The financial offering an instant payday loan so you can Washington residents have to have a licenses to accomplish this away from DFI. All pay check loan providers giving financing so you’re able to Washington people need follow this laws. If the pay check financial isnt registered, the latest cash advance is unenforceable. The financial institution dont gather on it. Whether your payday bank is asking a higher level than simply Washington laws lets, the latest payday loans are unenforceable. Get in touch with DFI quickly so you’re able to report like abuses.

Should i file a problem throughout the a payday financial?

Example: This new payday lender have moving their check with your bank, otherwise harasses that pay-off the borrowed funds. You ought to report which so you can DFI. You could potentially fill out a complaint mode on line within dfi.wa.gov/cs/problem.htm, otherwise label step 1-800-RING-DFI (746-4334) (TYY: 711 or step one-800-833-6388) or (360) 902-8700. You’ll be able to get in touch with DFI from the send or hands-beginning so you can 150 Israel Road SW, Tumwater WA 98501.