If you find yourself enduring financial obligation, it is easy to fall behind on the financial. You may have made an effort to improve payments promptly, but most other debts have chosen to take precedence, and you’ve got fallen behind on your own mortgage payments. You’ve got knew you might not catch up, nowadays care about foreclosure going on. Youre trying to puzzle out a way to save your valuable domestic.

To appreciate this choice, we shall take a look at just what an interest rate amendment is actually and you can what a mortgage amendment is going to do to you personally.

What is an interest rate Modification?

An interest rate modification was a different sort of contract you create with your financial to modify your regards to fees. These change are in the form of mortgage protection or an expansion of one’s name of one’s financing. The expression of your financing may be offered to reduce this new monthly payment otherwise they could clean out they towards the a portion of the debt. The newest modification may need you to make reduced repayments to own a good short period, next slowly improve money overtime to take them back again to the initial loan amount.

If you’d like to find a mortgage loan modification, try to contact your bank really and request in order to talk to a loan modification professional on qualifications. This new eligibility criteria are normally taken for bank to lender, although procedure initiate by giving requisite documentation, such as

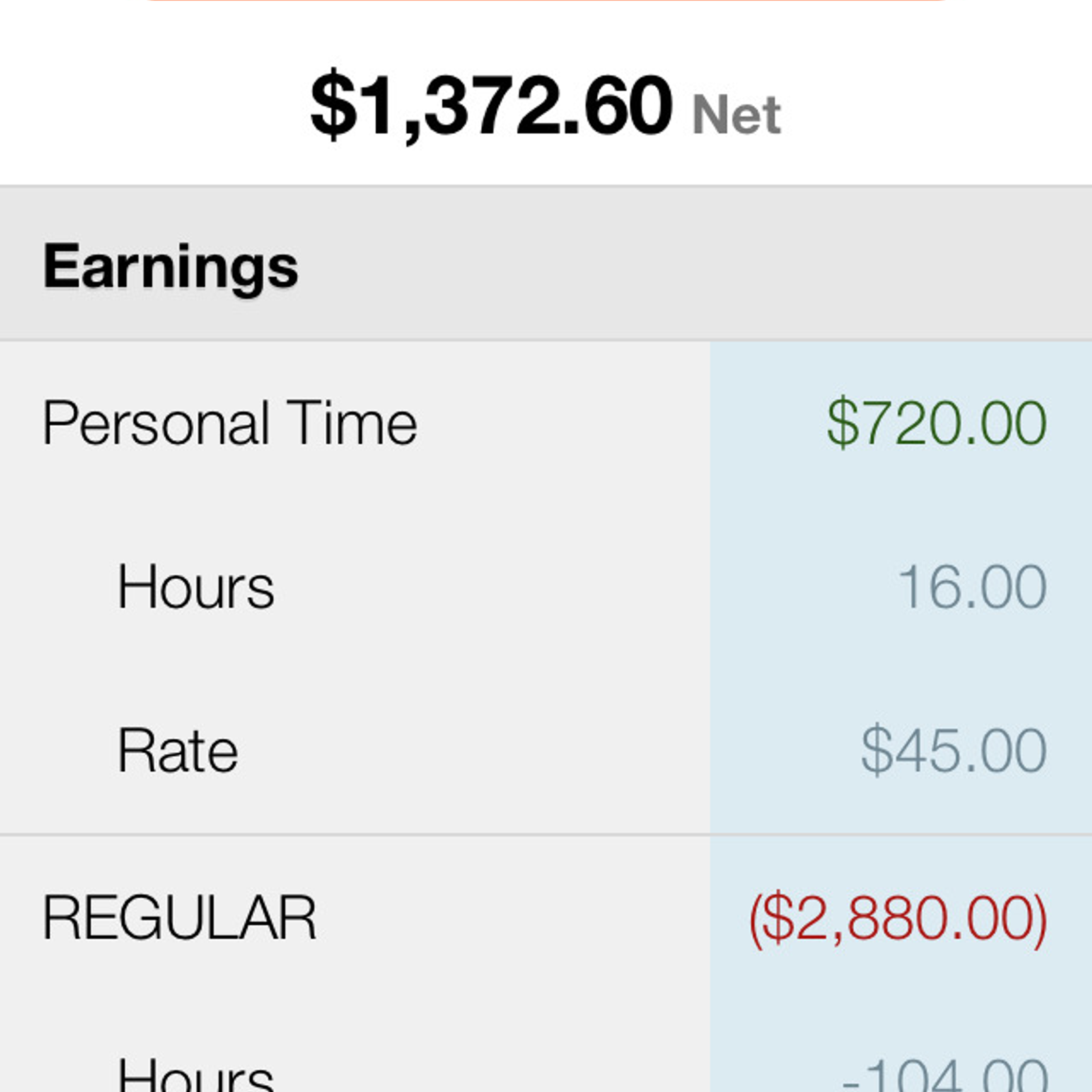

- evidence of money

- proof of costs

- paperwork of all of the debts

- bank comments

- tax statements for a specified few years

- page regarding difficulty

Once you have completed all the necessary documents and you can considering this new called for data, the lending company commonly remark your own request and decide into whether or not to give the fresh amendment.

Part thirteen Personal bankruptcy and online payday loan Maryland you can Home loan Amendment

Chapter thirteen personal bankruptcy may also be helpful include your residence away from property foreclosure. It assists earliest because property foreclosure gets put off during the acceptance process of their bankruptcy circumstances. This is exactly you can easily since when you document personal bankruptcy, a judge-bought automatic remain goes into put, and this forbids financial institutions out-of meeting with the debts if you find yourself your case of bankruptcy instance try running.

When you get accepted for a section thirteen Case of bankruptcy, the debt was reorganized into a case of bankruptcy judge prepared payment plan in which you pay back your own personal debt (i.age. credit cards and you will scientific costs) within 3five years, often from the a portion of its total cost. For your financial, because the secure personal debt, you would have to remain making the regular costs on the bank. However, bankruptcy will allow the fresh arrearages your debt with the mortgage as put in your own installment plan. This would will let you catch up on the late repayments throughout the years and this stop foreclosures.

Even if you will start investing mortgage arrearages due to a chapter 13 fees bundle, it is possible to still be in a position to focus on the lender to change your mortgage. You would contact your financial as discussed over if in case it approve home financing amendment, you must submit new contract toward bankruptcy court to have acceptance. The fresh new bankruptcy proceeding trustee otherwise legal would determine if new agreement are fair, in accordance with the value of the fresh new guarantee (your property) plus power to spend beneath the the conditions. Whether your bankruptcy proceeding judge approves this new arrangement, they generate an alternative Section thirteen installment bundle hence removes the mortgage arrearages.

Delivering Make it possible to Prevent Foreclosures

Understanding which economic choices to create to greatly help end a foreclosure on your household is going to be tough. It is a serious situation and requires an insight into financial and you can legalities.

The lawyer keeps over twenty five years of experience permitting customers prevent foreclosures. E mail us to own a free of charge review of one’s financial situation to help you see if home loan modification, part 13 bankruptcy, or a mix of both makes it possible to avoid foreclosures and you will stay in your home. Let us help your loved ones.