So you might be ready to pick a house, how pleasing! After you’ve spoke with a home loan banker regarding your finances, acquired pre-recognized, and discovered just the right domestic, you might be prepared to create an offer and be a resident. But what goes in and come up with a deal? We shall assist you by way of different problems lower than.

Putting together your give

This is how having a real estate agent is effective. Together, both you and your representative tend to draft and submit a deal. They including help you discuss, if necessary. The two of you commonly decide how far to offer to possess the property, and that their agent can help you on. Don’t be concerned – to make an offer isn’t as difficult whilst sounds. The realtor must have a simple give function you to definitely they will complete with your specific guidance, you don’t have to vary from abrasion.

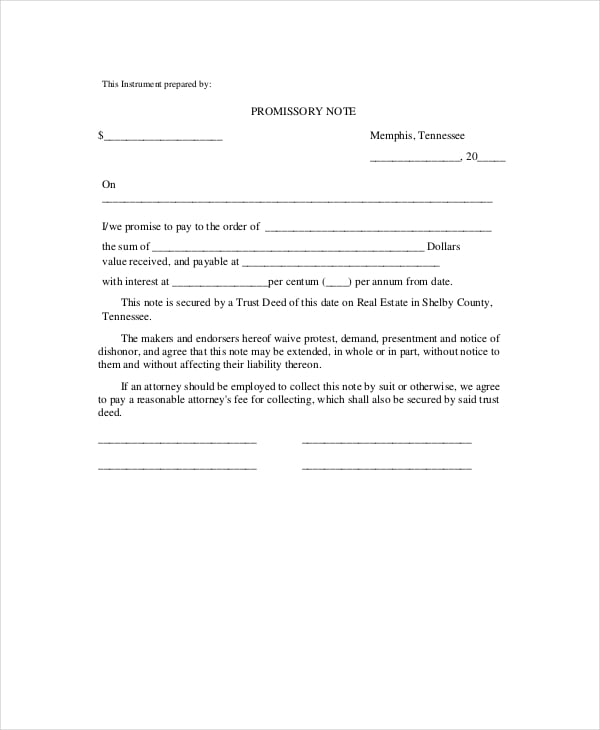

Just what data is Used in an offer

A pre-recognition page from your own financial banker is not needed, but can make your offer stronger (particularly in multiple bring situations, and therefore we’re going to talk about afterwards). An excellent pre-recognition letter suggests owner that you’re seriously interested in to find – you’ve already safeguarded financial support into the household, that could create your give get noticed over anyone who has maybe not. The agent submits your provide on your behalf towards provider otherwise seller’s representative and following that, several things may appear, and this we will discuss in the next section.

What are the results when you generate an offer?

Just like the a buyer, you should know that, in aggressive housing segments, numerous offer issues all are. Because of this although you installed a deal, anybody else wants our home, as well, so that they together with setup an offer. Either, there are also more than two even offers. In such a case, owner create buy the provide that’s very popular with them, considering things like just how-to close the deal is to the newest asking price (otherwise how far over) and you may questioned seller contributions in order to closing costs. Because a provider, that is good condition to settle, but given that a purchaser, it may be frustrating. When someone makes a far greater promote, owner could possibly get like theirs over your own personal. When you complete the give, two things may seem: the vendor normally take on your provide, deny your own give, otherwise avoid the offer. Why don’t we evaluate for each and every state.

Bring declined

When you make a deal, owner could possibly get determine they can not wade only you wanted that can refuse your bring. More often than not, they’ll prevent the give. if the gap in what they want and you may what you are willing to pay is simply too large, you may find you to definitely these are typically upset and additionally they completely deny your own offer. You could set up a different sort of offer in case your first a person is refuted, but the majority of people only will progress. Once again, the agent should be able to support an offer speed that’ll not get refuted.

Bring countered

Quite often, the seller often fill in a workbench render. Including, in your $two hundred,000 dream home, let’s say your provided $190,000 on the vendor expenses 3% off closing costs. The seller came back with a table provide: $195,000 having step 3% settlement costs. Both you and your agent usually mention and you can react, either having a different stop provide otherwise acceptance.

Offer recognized

If the everything looks good to the merchant as well as their agent, might take on your provide. Great job! Presently there are several exactly what you need to do:

Secure Funding. When you have come pre-acknowledged, you’re ahead of the game. Allow your bank understand it recognized your own promote and they will share with your 2nd methods. If you have not talked so you can a mortgage banker yet, it’s time. Come together to obtain all of the files and suggestions they require to deliver financing. Their lender should be able to let you the loan option that is right to you.

Acquisition our home assessment. this is done via your lending company. Anyway, your own financial wishes the home review complete approximately you are doing – it’s its capital, as well. Your house examination typically has to be done within this ten months of your own bring are accepted so you can personal timely. After the house examination returns, you and your agent makes a summary of situations you’ll such as for example handled from the provider and you will submit they into the seller’s broker. The seller normally discuss what they’re happy to (and not ready to) fix.

You are close to closing! Regarding few weeks amongst the provide acceptance and you may closure, your lender might be making preparations the loan getting closing. Much of this really works happens behind-the-scenes, but a good mortgage lender will keep you upgraded about process. Within date, you’ll safe homeowners insurance, work on the title organization, and then have their lender any last-second pointers they might you need.

Once your mortgage is obvious to close off, you can complete a final walkthrough of the house. Which constantly happens a day or two just before closing to ensure the domestic has not been damaged and this what exactly on no credit check installment loans Jacksonville household evaluation was basically treated. In the event that all of the happens better, it’s the perfect time getting closure. Once you to remain the fresh new dotted line, you may be technically a resident.

An excellent pre-recognition isnt a pledge out-of a last loan acceptance. One matter change to credit history, a position reputation, or financial position could possibly get impression last financing approval. Most of the funds subject to high enough assessment, clear possessions title, and last borrowing recognition.