Power to pay back

All of the lenders keeps an appropriate obligations to make a good, good faith commitment from a customer’s ability to pay off people consumer borrowing from the bank transaction safeguarded by a home.

To put it differently, they must test out your funds in more detail. As they must ensure you could conveniently manage their month-to-month mortgage repayments, domestic equity mortgage, otherwise house equity personal line of credit (HELOC).

It is known as ability to pay provision. They handles facing predatory financing to the people that have absolutely nothing options out-of paying its mortgage loans.

Income regulations and you can rule brands

Mortgage brokers the have the same court obligation to ensure their ability to pay off. However some translate one responsibility in another way. And if you are turned-down by the one to financial, it may be really worth looking to other people.

If you want a national-backed financial, the principles towards the income for home loan certification are written rather securely. Those authorities-supported mortgage loans is Government Homes Administration (FHA) fund, Institution out of Pros Products (VA) finance, and You.S. Company from Farming (USDA) finance.

Fannie mae and you can Freddie Mac in addition to closely specify the income streams they truly are ready to undertake having traditional finance. not, the individuals aren’t carved in the stone. Conventional mortgage loans is significantly more versatile regarding earnings qualifying than just authorities-supported mortgage loans.

Regulations

During the really outstanding circumstances, loan providers could possibly get bend some income laws and regulations having favored consumers. Including, assume you’ve been which have a district organization for decades. In the event it knows you’ve got an unblemished fee number and you will an effective excellent credit score, it could be ready to flex policy a tiny.

Similarly, Fannie and Freddie build its laws and regulations having version of financial affairs. Such as for example, Fannie usually excludes leasing earnings regarding home financing software. However it produces a different because of its HomeReady mortgage. For those who submit an application for among those, Fannie is also number the income you will get away from boarders and you may renters, given they’ve stayed along with you for around a-year previous to buying the house.

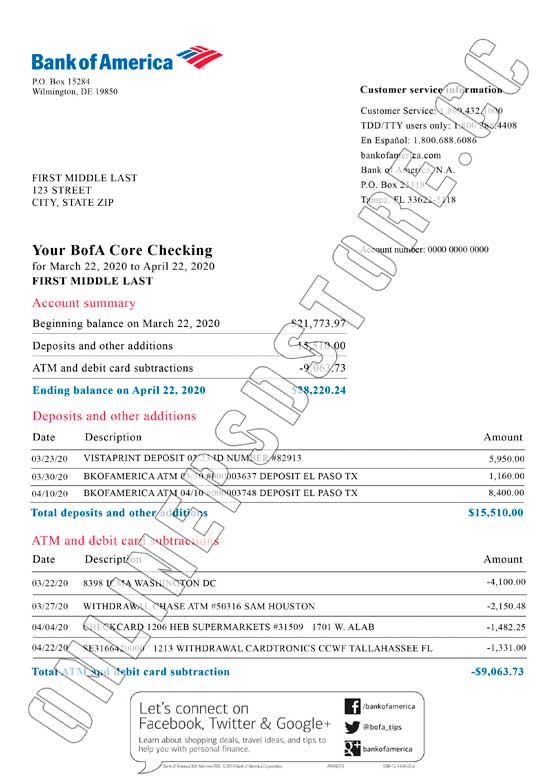

You can utilize a multitude of earnings supplies so you can be considered but you need show a reliable reputation for getting one money. And you will lenders should be able to verify it can keep for the the near future. You’ll have to establish people income source using taxation variations, lender payday loans Jewett City no credit check and you will funding membership comments, spend stubs, and other important documents.

Additional factors one to number whenever being qualified getting a home loan

You will need over qualifying income discover accepted to possess a great home loan app. Lenders take a look at some affairs. These are generally:

- Debt-to-income ratio (DTI): Loan providers use your DTI ratio to compare your total month-to-month personal debt towards gross monthly money. This shows the economical burden in your home finances. Obligations include payments toward car and truck loans, student loans, and mastercard money, to name a few. The low the DTI ratio, the higher your chances of mortgage acceptance

- Credit score: You can easily basically you need a credit score of 620 or more so you’re able to qualify for a normal mortgage, however some earliest-big date home buyers can also be qualify for an enthusiastic FHA financing which have results only 580

- Deposit: Really borrowers requires about 3% down to own traditional mortgages and you can step three.5% down to own FHA financing. Keep in mind that you can easily shell out private financial insurance (PMI) instead of 20% down on a conventional financing. And you will home loan insurance premiums (MIP) is required to your an enthusiastic FHA financing, despite down-payment number. Both USDA and you can Va money require no deposit after all

- Resource and money reserves: Of many lenders and you will loan programs wanted buyers to possess sufficient dollars reserves or disaster loans once closure into the an alternative family. This indicates that you’ll be able to make their monthly home loan payments in the event the your income stops