Contrast Club accepts zero responsibility for your losings arising from any use of otherwise reliance on any computations otherwise findings reached playing with the latest calculator.

Advice like interest levels cited, and default figures, and you will formulae utilized in new presumptions was subject to changes in place of notice.

In the most common situations, yes. It is because after you re-finance your property loan, you’ve already ordered your property. Their lender have your primary related financial pointers, and they have monitoring of your repayments.

If you’ve had your home for quite some time, you will have likely built up particular security. This would build refinancing much easier. After you refinance, you will be fundamentally asking so you can borrow secured on an inferior part of their residence’s total really worth.

Some lenders has recently introduced ‘fast track’ refinances, that are smoother and easier to help you qualify for than while you are trying to get their first mortgage.

Do i need to re-finance my personal financial or make more home loan repayments?

For many who actually have home financing complete with an offset otherwise an excellent redraw account, possible use this to assist pay the loan down smaller, or even help you in accumulating a boundary up against upcoming lifestyle pricing rate unexpected situations https://elitecashadvance.com/loans/student-loans-without-co-signer/ – in addition to people interest rate grows.

That said, if you have these features but aren’t using them much, consider a loan without additional features – because it might have a lower interest rate or fewer fees. For some people, more dollars in their pockets now matters more than how much they’re putting away for later. Find out more: Evaluate Club’s help guide to Offset and you will Redraw account .

Be sure to browse the small print in your financing contract as there are always punishment for making extra costs too often, specifically throughout the a predetermined-interest rate several months.

For people who re-finance so you’re able to mortgage loan which is less than the newest that you used to be purchasing just before, and you’re capable remain make payment on exact same number every month, this will pay off your property financing shorter because the a lot more of your repayments try paying off their prominent loan, much less is just about to your appeal costs.

What’s a home loan re-finance rate?

There are not always various other rates specifically for refinancing your residence financing. What is actually commonly provided, is a competitive interest or plan to draw you, because the you are a top worth borrower having demonstrated you might repay your home mortgage.

Refinanced lenders can be handled quicker on account of which, and lots of lenders have started offering a fast track refinance processes for which you need not jump owing to nearly as much hoops since a different sort of home loan applicant carry out.

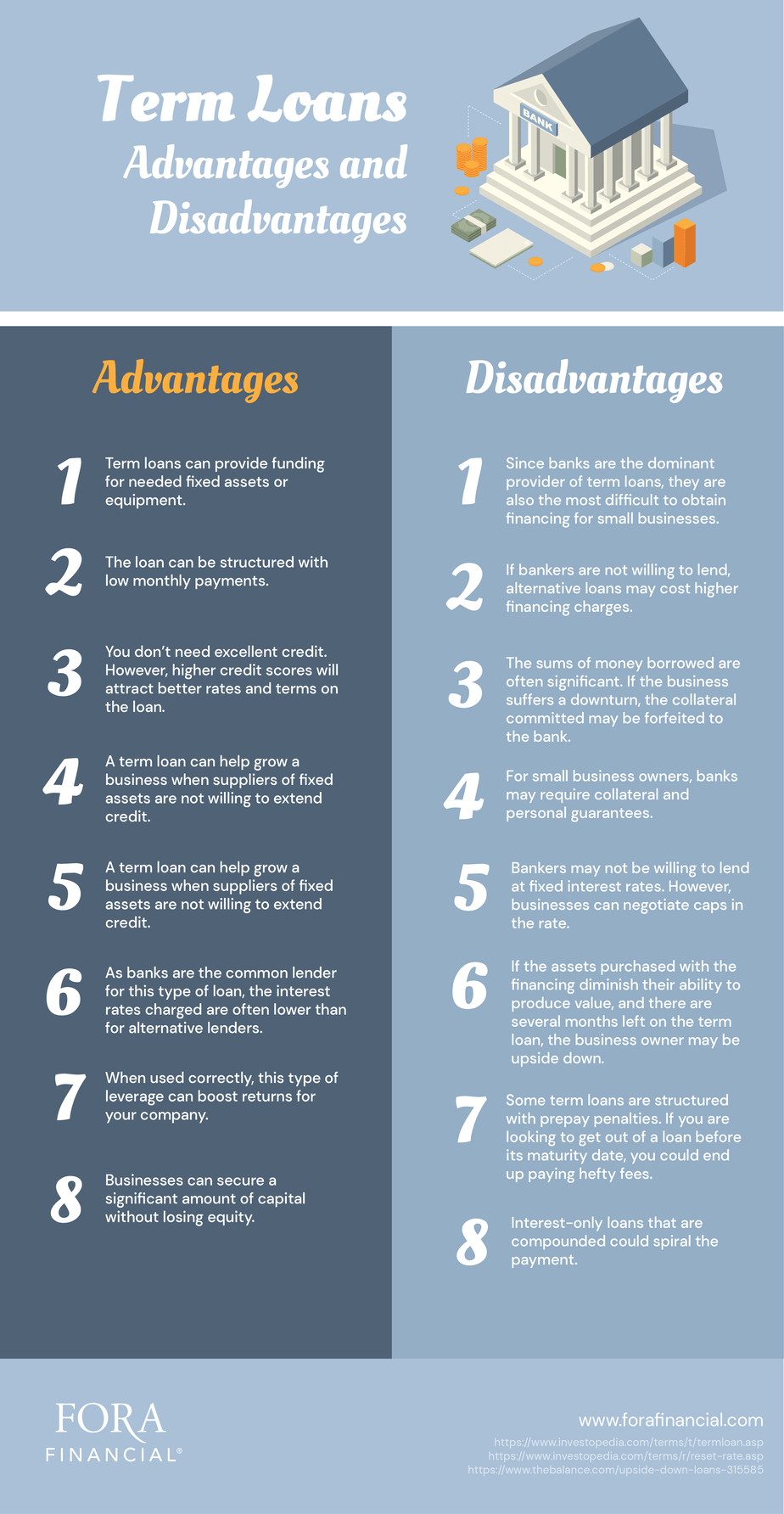

Exactly what are the benefits and drawbacks off refinancing?

It’s important that you consider your current financial needs before to make a key and you can refinancing . Here are some of the pros and cons to factor into your decision:

Pros:

You will be capable protected a reduced interest than your mortgage, making your instalments alot more under control.

Based on your current bank, you’re able to influence new equity you’ve collected typically to minimize their interest rate or reduce your loan amount (and therefore your repayments).

You have got way more liberty to choose your dream lender, mortgage kind of, count and you will length after you refinance as you features a verified history of controlling the early in the day loan better.

Cons:

Depending on your current rate of interest, your discounts is restricted particularly when your cause of your own costs to have refinancing.

In the event the guarantee is lower than 20% of your own property’s worthy of, you may need to pull out Loan providers Financial Insurance coverage (LMI) , that may increase the loan count.