Honest Luisi

Frank try a vice-president within Own Right up where he’s in control getting organization development and you can starting new services. He or she is a licensed property/casualty and you can term insurance coverage music producer.

This will be an upgrade for the study i published from inside the 2022 one to unsealed new difference inside the mortgage interest levels accessible to Virtual assistant borrowers because of the top 20 Va lenders. We have been updating these details and you can highlighting what is altered, and just what hasn’t, to possess Va consumers.

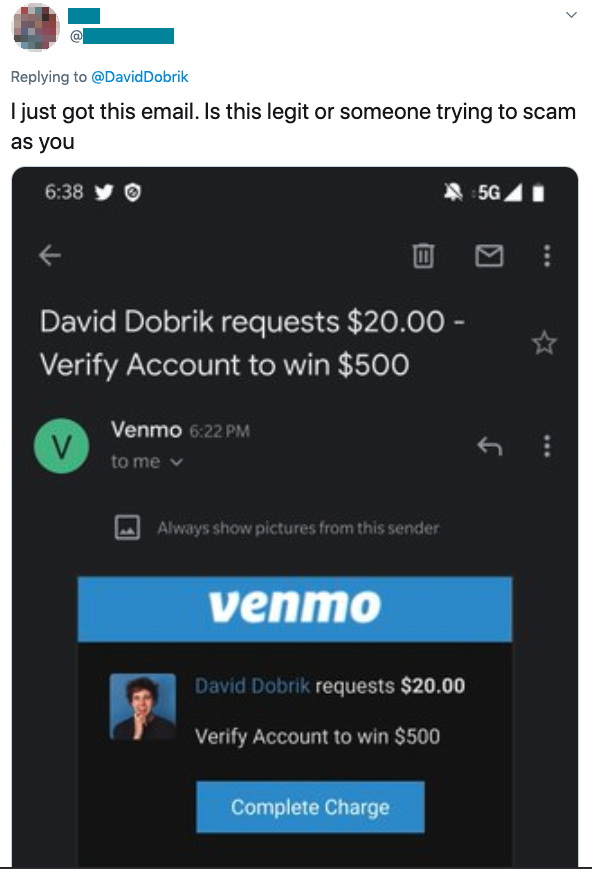

What exactly is noticeable from your research is that every consumers commonly addressed just as, and this stayed real inside the 2023. It is vital that experts look around as studies away from HMDA shows that rates of interest and settlement costs will vary generally certainly lenders.

1. Lenders place large income toward Va fund

Mortgage brokers say that Va financing purchases be more difficult to techniques and take prolonged to close than just conventional financing. Loan providers make use of this argument so you can justify charging you highest rates https://paydayloanalabama.com/hayneville/, which leads to a top earnings research of the Experts United Domestic Fund comes to an end you to definitely Virtual assistant loans close contained in this forty so you’re able to 50 months, that’s normal for the home loan business.

Lenders also try so you’re able to validate highest home loan cost from the stating one delinquency prices to have Va consumers was more than those individuals getting conventional individuals. However, study regarding Mortgage Lenders Relationship provided on chart below, signifies that the much time-work on average off delinquency cost for Virtual assistant funds is a lot like that old-fashioned fund.

For these alleged inconveniences, lenders fees a whole lot more. That it held true inside the 2023 just like the rate diversity certainly ideal Virtual assistant lenders improved of the over fifty percent a portion reason for 2022.

Which have total financing wide variety in the huge amounts of bucks certainly better loan providers, and you can mediocre loan number exceeding $3 hundred,000 for top 10 loan providers, Va consumers must make sure that they are not-being drawn advantage out-of. I have included the newest 2023 U.S. Agencies away from Veterans Situations analysis in the after the graph:

Virtual assistant loan providers is actually registered by law so you can charges origination costs away from up to step 1% of one’s loan amount. At the same time, traditional financing normally start around ranging from 0.5% to at least one% of the loan amount, that are often reduced in deals. Hence, Va borrowers should make sure that they’re not energized extreme charges. Virtual assistant borrowers also can anticipate good financial support fee, which in 2023 was a-one-date fees you to varied doing 3.3 % of your own loan. This might be along with the allowable itemized closure costs and the individuals into the financing recording, credit history, label examination, term insurance policies, and you will prepaid/escrow affairs. Inside the sum, Virtual assistant consumers is actually spending a great deal initial, and some of these fees are entirely on power over lenders.

step three. Va consumers try regular plans of loan churning systems

The fresh new Virtual assistant system cited several loan providers within the 2018 which have predatory credit methods and that inside it battery charging premium cost and you may costs on mortgages and you will following targeting these with offers to refinance its home loan many times into the a-year, often without the significant financial work for. Brand new design tend to used the bucks-away re-finance, hence quicker the newest borrower’s equity in their house. Because Virtual assistant system allows individuals to move mortgage closing costs to your financing harmony to your refinances, these transactions carry out will improve borrower’s overall financing balance, leaving them ugly into the financial, or owing more than just what house is worth.

Even in the event individuals laws was in fact applied to combat churning techniques, borrowers still have to be cautious. A good 2021 declaration out of a tangerine County affiliate titled: AWOL: How Watchdogs was Failing continually to Manage Servicemembers out of Monetary Scams» cards one possibly harmful bucks-away refinances enhanced in half between , exhibiting why these plans may go hand-in-hand having markets rate drops. Its something that Virtual assistant individuals are going to be mindful of if cost .