However, the house need to see Va minimum assets requirements when you look at the for each circumstances. The right representative will know things to come across and will really works really together with your lender to make certain the Virtual assistant mortgage schedule remains focused.

step three. Heading Around Price

Which have a trusted broker plus Virtual assistant mortgage preapproval letter, its merely an issue of big date just before a supplier accepts the get provide. Getting the offer accepted is frequently referred to as taking «significantly less than deal,» because it’s the brand new official kickoff to invest in transactions amongst the consumer and you will provider.

Getting the give accepted is great information and really worth honoring, however, you can still find a few measures remaining if you don’t can also be telephone call the home a:

- Share the package information together with your financial

- Order a home review (recommended)

- Have your lender purchase a good Va appraisal

At this point, the lender is always to leave you a better concept of exactly what closing will set you back and fees to expect, including identity otherwise financing charge. There are even specific low-deductible costs one to Virtual assistant consumers usually do not spend. Particular buyers even inquire suppliers otherwise loan providers to fund some of these closing costs as an element of constant dealings.

While you’re sorting out of the get contract facts into https://www.paydayloanalabama.com/rosa/ supplier, the lender often move on on the second step from the Virtual assistant financing timeline-underwriting.

4. Virtual assistant Financing Underwriting

Your financial begins the fresh homework to be sure you can spend the money for home from the price shown of your property offer.

Normally, loan providers employ an automatic Underwriting Program (AUS) to evaluate a beneficial borrower’s creditworthiness rapidly, streamline the mortgage approval processes, and relieve the probability of peoples error. They are going to plus likely explore a keen AUS once you submit an application for preapproval.

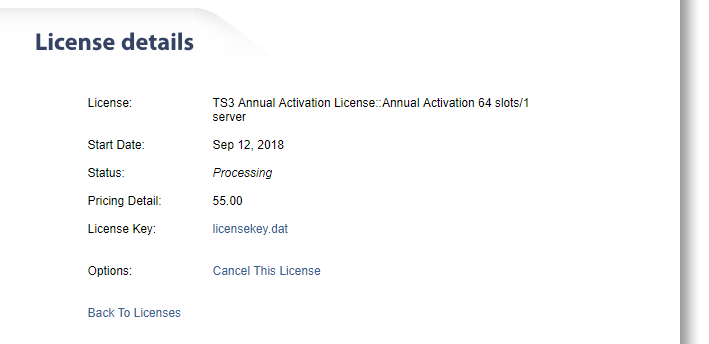

Although not, some borrowers with exclusive monetary issues, such as those no credit history, is almost certainly not approved by an AUS. If the a keen AUS denies your, it is far from the conclusion the street.

You could potentially request instructions underwriting, which is when a person underwriter requires a closer look at the your financial character. This process takes offered but could bring about a good impact to the borrower.

The new underwriting team usually wait for the Virtual assistant assessment ahead of signing the loan file and you may giving a «clear to shut.»

5. Closure on an effective Virtual assistant Financing

Closing on your home loan is a huge fulfillment, while the Va financing closure schedule is quite the same as almost every other mortgage closings. They begins with your own Closing Revelation.

The law requires that you will get an ending Disclosure from your own bank about three working days before the loan closes. Your Closure Disclosure will show what you should are obligated to pay towards closing big date, in the event that anything, including:

- Down-payment

- Representative fees

- Title costs

- Other settlement costs

Their bank have a tendency to comment which file to you and you may respond to people issues you have so that you is totally alert to exactly what you borrowed and why. Buyers tend to create a last walkthrough of the house before closure to make certain things have resided an equivalent while the heading under bargain.

What to expect into Closure Date

An ending time meeting can take step one-couple of hours, according to characteristics of one’s get agreement within consumer and provider. However, it is required so you can cut off more hours become safe and grab your time evaluating the latest records.

Anticipate to signal one last paperwork. Your label organization commonly take you step-by-step through for each area of the closure files they’ve prepared on your as well as the seller’s account. In the event the data can be found in buy, you are going to afford the downpayment equilibrium, if any, plus share of the settlement costs.