When a business really wants to purchase commercial assets, but doesn’t have the capacity to shell out cash for this, a commercial mortgage are often used to loans industrial property.

The income of team, along with its winnings, power to repay the loan, as well as the most recent economic climates, could be with each other considered of the lender during the assessing chance. Detail by detail here are a portion of the criteria for getting a professional financing.

Equity

Typically, loan providers have to have the possessions getting purchased to serve as security to own the borrowed funds. Which provides to guard the new lender’s financing and provide all of them brand new directly to grab palms of the home should the borrower getting incapable of see the home loan loans. Lenders commonly make an intensive assessment of the house to make sure it has enough well worth to cover number financing regarding skills from a standard.

Loan providers use a formula known as the financing-to-debt ratio hence requires including to one another the web based money of the debtor additionally the property’s market price since dependent on a recently available appraisal, and breaking up the level of the general financial by this contribution. Really lenders require a portion of less than 75%.

The firm is typically needed to inhabit more than half off the structure for which they are getting capital. In case your company is not planning satisfy which requirements, an investment property loan could be appropriate.

Income

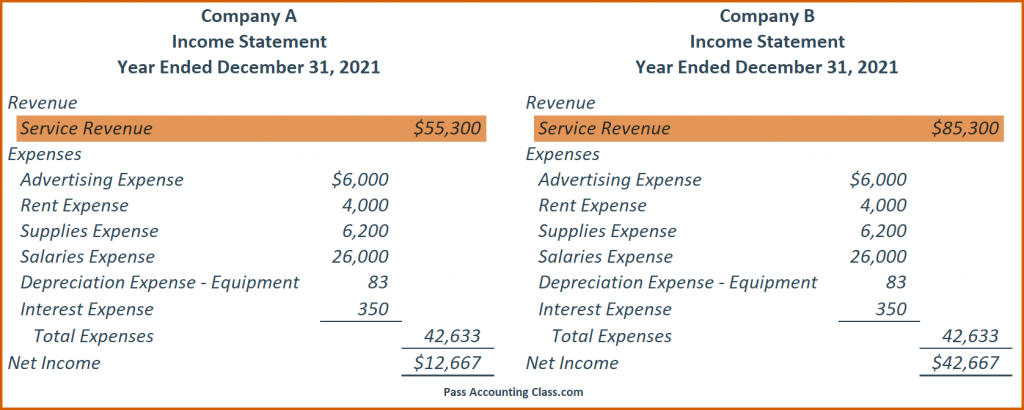

Another essential issue is the cash flow of one’s organization and you will the way it comes even close to their personal debt. Extremely loan providers prefer a constant net income of at least 20% more than your debt of the borrower. Small enterprises are thought becoming loan places Tabernash greater risk on account of an effective higher fail price; therefore, lenders fundamentally study its money very carefully.

To demonstrate their cash circulate, consumers was requested to provide detailed comments of the expenses and money along with other budget-associated issue. To choose exposure, the lending company will additionally consider the exposure to the property owner(s), brand new success rate of one’s company, and how enough time it has been performing. The latest borrower’s proof of property or discounts that may later be transformed into bucks, have shown their ability to pay the borrowed funds if there is a primary business losings.

Organization Credit

The credit get of your providers is likewise examined in order to dictate eligibility therefore the terms, like the minimal deposit expected, pay months and rate of interest.

A small business have to be prepared just like the an S agency, limited-liability business, or any other form of business organization to help you be eligible for a professional mortgage.

Guarantor Money and you can Property

In some instances, the lender may also wanted a beneficial guarantor getting a commercial financing; this will be typically the owner of the providers. This person can make sure the financing could well be paid-in the big event your team non-payments.

Lenders will feedback the property, credit and you may money of your own guarantor. To meet the requirements, its credit history and you will credit score should see the needs founded of the lender. Entrepreneurs having previous courtroom judgments, tax liens, defaults, property foreclosure and other monetary affairs possess a lower life expectancy risk of acceptance.

Rental Money

If the property being financed may also serve as a commercial leasing, the lender often consider the expected rental money in choosing cash disperse. The borrower may be required to help you sign over to the financial institution, the monetary interest in new rent income. But not, the financial institution only be permitted to bring that money if the the debtor cannot afford the financial.

The new recognition processes getting commercial loans will likely be rigorous, however, are wishing produces the process convenient. There are a few tips small enterprises usually takes to boost the likelihood of recognition.

For a corporate with more property, offering so you’re able to vow them since equity will get satisfy a few of the lender’s risk. Incorporating an effective cosigner otherwise individual, and you can taking methods adjust its credit history, such as for example by paying off any existing debt, is also beneficial for boosting likelihood of approval.

In some instances, agreeing to expend a higher rate of interest or big deposit may be a lender provided solution. If a corporate remains incapable of qualify, they could find a less expensive house is the best way pass.

Woodsboro Financial opinions the success of the community and functions tirelessly to support regional companies. If the company is provided a commercial a property pick, the pros on Woodsboro Lender have a tendency to cheerfully present custom suggestions to help you simplify the process. Call us today to speak about the choices and commence the application procedure.