The latest PMT means within the Prosper functions as a robust product getting calculating mortgage payments. Insights its components and just how it interplay is important getting real data. Let us explore the fresh post on the fresh PMT algorithm and its relevance in the deciding monthly payments.

PMT Algorithm Evaluation

This new PMT mode computes this new repaired payment per month expected to repay financing, provided lingering money and you may a reliable interest along the loan’s period.

Areas of new PMT Formula

- Interest for each and every PeriodThe interest rate is generally an annual contour, thus to alter it so you’re able to a month-to-month speed, its split from the 12 (number of months when you look at the a year). As an instance, a yearly speed from 6% gets 0. = 0.005 month-to-month interest.

- Quantity of Payments (Financing Identity)It component is the total number off money from the loan title. For instance, a great 10-12 months loan involves 120 monthly payments (ten years * 12 months/year).

- Mortgage AmountThis indicates the total lent count, such as for instance $200,000 in our example.

Choosing Monthly payments

Brand new PMT algorithm uses this type of portion to help you calculate brand new repaired month-to-month commission needed to repay the loan. As an instance, PMT(0.005, 120, 200000) computes the fresh payment per month according to a beneficial six% yearly interest rate, 120 full money, and you can an effective $200,000 amount borrowed.

Example which have Varied Conditions

By the modifying the constituents of your PMT formula-rates of interest, mortgage durations, or financing amounts-ranged circumstances is simulated. For example:

- Modifying the rate exhibits just how high cost result in larger monthly obligations.

- Modifying the loan title depicts brand new impact away from quicker otherwise expanded periods on monthly premiums.

- Switching the borrowed funds matter shows you america cash loans Haleburg how credit just about has an effect on monthly payment obligations.

Knowing the PMT algorithm equips individuals it is able to analyze other loan circumstances truthfully. It allows them to create advised choices by the foreseeing the new economic duties with the varying loan words and you will numbers. Excel’s computational capabilities streamlines this process, helping profiles to evaluate its mortgage payment loans effortlessly.

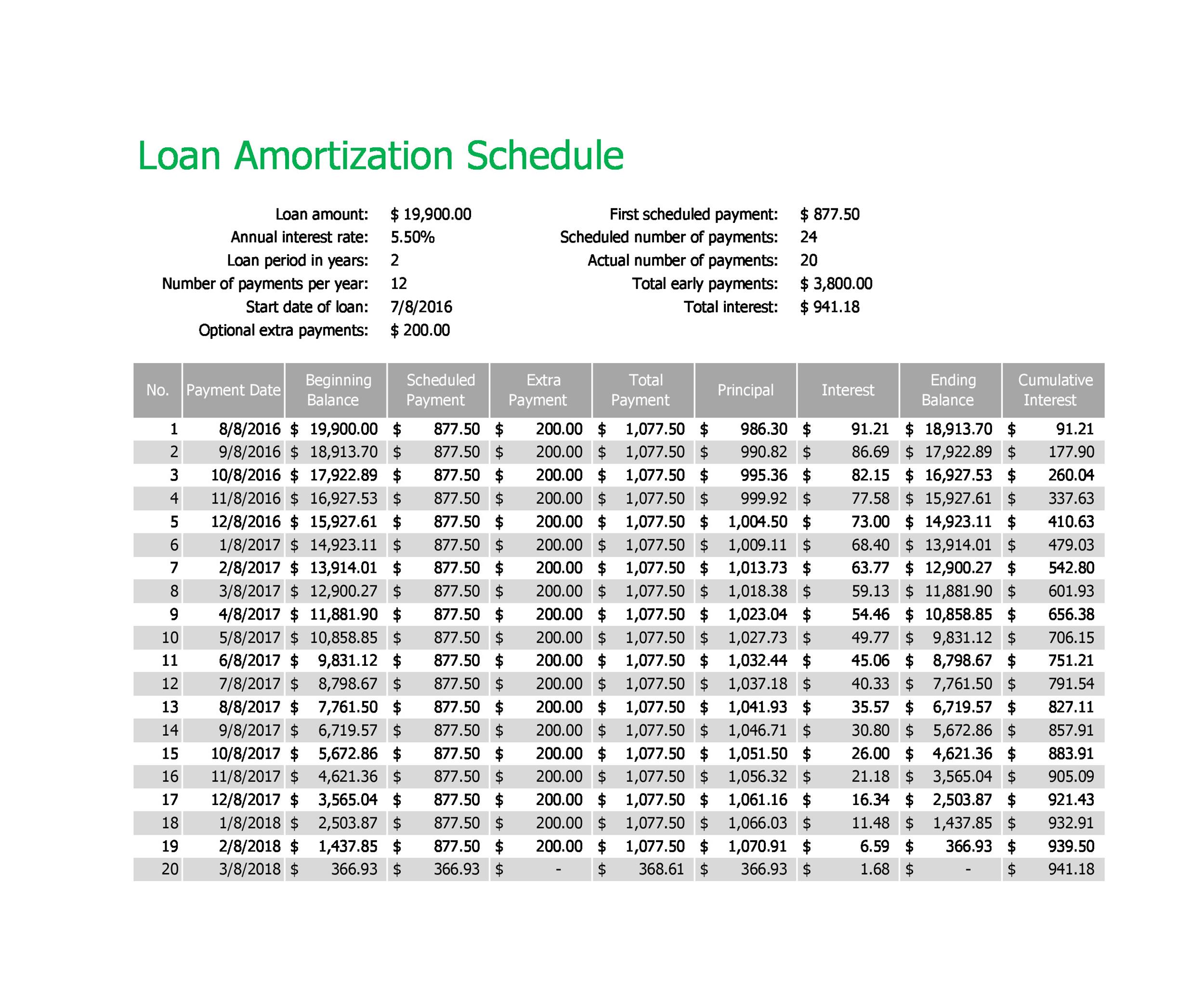

Full Loan Research that have Prosper

When delving into the financial calculations, supposed beyond mere monthly obligations provides an alternative understanding of the brand new investment decision. Unveiling formulas so you can calculate the complete appeal paid down in addition to total mortgage cost is crucial to have a comprehensive mortgage study.

Figuring Overall Interest Paid down

Brand new IPMT(., 120, 200000) algorithm performs a pivotal role into the measuring the brand new amassed attention over the mortgage identity. Which formula exercises the interest bit to possess a particular fee within the borrowed funds name. Like, on the offered formula, in the a beneficial six% annual rate of interest, that have 120 overall costs, and you will good $2 hundred,000 loan amount, the newest IPMT formula suggests the interest paid for a particular several months inside mortgage label. By summing-up this type of appeal repayments across the every attacks, the interest paid off over the financing course are truthfully computed. Knowing the IPMT algorithm aids consumers within the knowing the distribution from focus repayments across each repayment regarding loan’s lifespan.

Deciding Full Loan Pricing

The significance of the fresh new formula lies in its ability to calculate the general obligations with the mortgage. Of the because of the sum of all of the monthly premiums, as well as both prominent and you can focus, along side loan’s whole duration, that it formula exercise the total cost of the borrowed funds. This holistic position facilitate individuals understand the total debts obtain, related both the dominating amount borrowed while the compiled attract. Expertise so it formula equips consumers which have an obvious grasp of your own complete investment decision they accept when stepping into a home loan arrangement. It supports making informed conclusion from the loan words, budgeting, and you may full monetary thought.