Dining table regarding Information

- Truist’s thousands of financial twigs render users towards selection for in-people direction.

- The company is actually an enthusiastic SBA Prominent Lender with many several years of feel powering consumers through the application procedure.

- Consumers meet the requirements to possess offers when they together with lender to the financier.

- There is no online application for SBA financing using Truist.

- The business’s financial branches are concentrated within a few places of You.S.

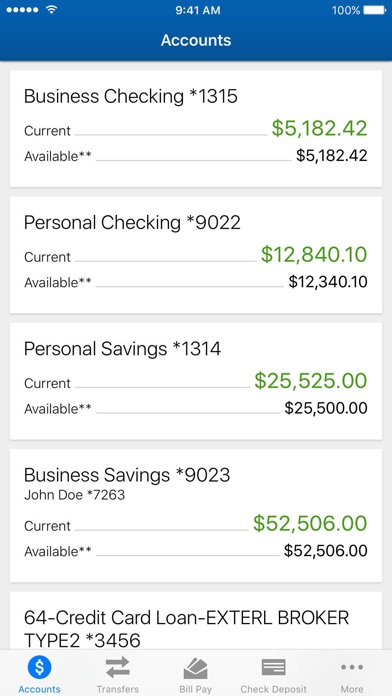

Truist are a primary You.S. financial formed into the merger of SunTrust Bank and you can BB&T Lender within the 2019. That it conventional financial offers numerous U.S. Small business Government (SBA) finance, name funds, lines of credit and you may devices investment. Truist has almost 2,800 brick-and-mortar lender twigs to have into the-people service. Advertisers having an excellent Truist bank account are even eligible for deals into the rates of interest.

Truist Editor’s Get:

Small business owners looking to secure one of the SBA’s sought after funds must provide a great amount of documentation. That have almost dos,800 bank branches regarding You.S., Truist was well-arranged to support people from the records privately. A loan provider which have detailed sense navigating so it funding process and alternatives for face-to-face consumer recommendations can prove invaluable, that’s the reason we picked Truist as better bank to have advertisers trying to SBA fund. The two banking institutions you to definitely matched to create Truist each other has actually ages of expertise handling the fresh SBA due to the fact common loan providers.

Loan Designs and Prices

In addition to SBA fund, Truist now offers its own title funds, providers personal lines of credit or other industrial financing solutions.

Term Financing

Truist’s business term financing goes up to help you $100,000, with regards to as much as five years offered. Such extended-title money are a far greater solutions than simply business lines off borrowing if you wish to create a big one-big date get otherwise finance another type of growth step. Having a term loan, you’ll relish repaired payment terms and lower prices.

That novel advantage of coping with Truist to suit your term loan are its reduced prices for checking-account holders. Getting small business people that take care of a bank checking account having Truist, the financial institution often shave as much as 0.50% out of their rate of interest. For the a large, multiyear mortgage, so it disregard could add up to hundreds otherwise several thousand dollars for the deals.

SBA Money

SBA loans offered through the U.S. Home business Government in conong advertisers with their low rates of interest and versatile terms and conditions. Such financing is supported by regulators promises, meaning that loan providers have the ability to take on risks that might if you don’t stop a corporate from getting capital. [Understand relevant blog post: And that Authorities Funds Are available to Entrepreneurs instant same day payday loans online Maryland?]

SBA financing are used for many intentions. The brand new SBA 504 loan program particularly can help you and acquire a residential property to suit your needs. The 504 mortgage normally in addition to the SBA seven(a) program getting big orders.

Though SBA financing provide flexibility and you may positive terms, applying for them takes more performs than simply it could some other investment products. Keep in touch with a great Truist affiliate to see if your meet the requirements and you will assemble info with the implementing. In lieu of most choice loan providers you to mainly do business on line or higher the phone, Truist maintains big system away from brick-and-mortar lender branches that have personnel who can help direct you owing to this new mind-numbing SBA application techniques yourself. Nevertheless, you may also want to consider all of our breakdown of Balboa Investment for another high-high quality SBA-recognized lender.

Most other Financing Systems

Other investment possibilities available as a result of Truist are auto and products finance, a house funds and credit lines. Truist’s vehicle and you can devices money can be funds up to $250,000 off commands, having words you to extend as much as half a dozen many years. Truist have a tendency to fund 100% of purchase price, and additionally delicate can cost you including installment. The business’s team personal lines of credit rise to $100,000 for several to help you 36 months, that is an extended name than many other lenders we assessed offer.