- Hence term length? Consider your desires having paying the mortgage. If you prefer all the way down monthly obligations, you could eg a longer name, including 3 decades. But if you are ready to create highest money to pay off your financial sooner, you may want a smaller term.

- People special factors? When you find yourself during the another reputation, for example building your house, you could squeeze into a great nontraditional variety of financial.

Prominent

If you use $2 hundred,100 on lender, then dominant was $200,100000. You can spend a small piece of which straight back monthly.

Interest

If the financial recognized the mortgage, your decided on mortgage – the cost of the loan. The eye is made into your monthly payment.

Property fees

The quantity you pay during the possessions fees depends on some things: the analyzed worth of your house plus mill levy, and therefore varies according to your area. Your house taxation can add on hundreds otherwise plenty with the mortgage payments per year.

Homeowners insurance

The average annual price of homeowners insurance are $1 payday loans Blue River,249 within the 2018, according to newest launch of the homeowners Insurance policies Report because of the Federal Connection off Insurance coverage Commissioners (NAIC).

Financial insurance policies

Individual home loan insurance (PMI) is a kind of insurance policies one to protects the financial should you prevent while making costs. Of several lenders want PMI if the downpayment are lower than 20% of the home well worth.

PMI could cost between 0.2% and you can 2% of mortgage prominent a year. If the mortgage try $two hundred,100, you might spend an extra commission anywhere between $eight hundred and you will $cuatro,000 a-year up until you paid back 20% of your home worthy of no extended need to make PMI money.

Remember that PMI is to own antique mortgage loans. Almost every other mortgage loans has their particular mortgage insurance policies that have more groups of legislation.

Mortgage terms and conditions you will have to understand

When purchasing property, there’ll be loads of jargon. Check out of the very well-known home loan-associated conditions you can hear and what they indicate:

- Lender: This is the providers that delivers you home financing, otherwise lends your currency to shop for a home. A loan provider was a financial, borrowing from the bank union, or any other sort of business.

- Borrower: That is you! You might be credit funds from the lending company to buy your house.

- Advance payment: Your down-payment ‘s the count you already have within the bucks to the family. The minimum downpayment relies on which type of mortgage your rating, therefore usually ranges of 0% in order to 20%.

- Principal: This is basically the matter you acquire for the financial. Imagine if you purchase a beneficial $3 hundred,000 family. You really have $30,100 to have a down-payment, so that you need to acquire the rest $270,100. Your own prominent is $270,one hundred thousand.

- Rate of interest: Focus ‘s the payment charged by the bank getting loaning you currency. Your prominent and desire try folded to your one to commission every month.

- Amortization schedule: Amortization involves settling financing by making typical costs. Home financing amortization plan shows just how much it is possible to spend monthly toward your mortgage. The brand new schedule reduces for each payment of the proving how much from brand new payment goes to your principal and you may with the attention.

- Disregard points: You could shell out a fee at closing for a lower attract rate on your own mortgage. One to discount area usually will cost you step 1% of one’s financial, and it also cuts back your rates because of the 0.25%.

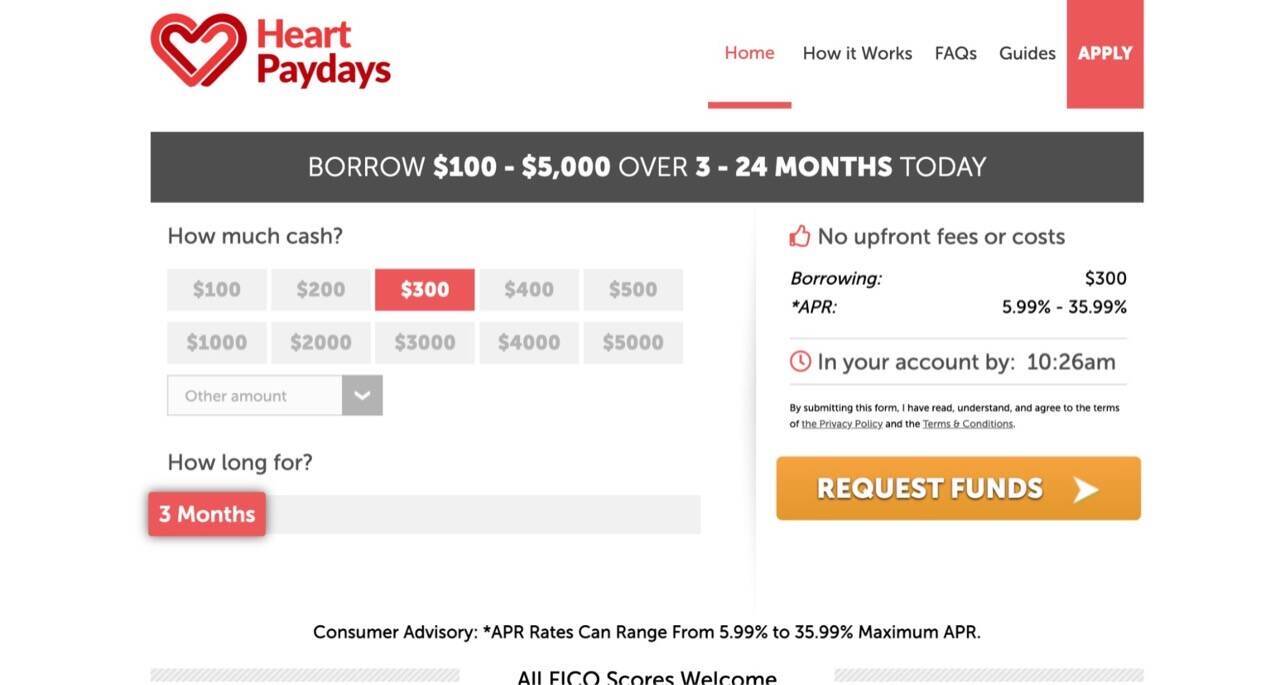

- Yearly percentage yield (APR): The mortgage Apr is the interest rate in addition to can cost you regarding such things as dismiss products and you will charge. This amount exceeds the rate that will be good much more specific symbolization regarding just what you can easily indeed pay on your financial per year.