Be eligible for a colorado USDA Financing

When you need to pick a property regarding county off Texas, a traditional financial might not be the most suitable choice. In case the house is beyond urban areas, a USDA Outlying Development loan is more suitable to suit your conditions.

For many of us, purchasing a home stretches the earnings, but if you be considered to have a great USDA loan, it might be much easier on your own funds. The USDA Outlying Casing financing system was designed to help house buyers inside the qualified outlying parts, making it possible for lenders to offer money so you’re able to individuals just who you are going to or even discover it difficult to get home financing.

When your residence is during the an eligible city, the us Agency of Agriculture’s home loan system even offers professionals more than other types of mortgage loans.

No Off Payments

You don’t have to love rescuing a giant advance payment by using good USDA-secured financing. Together with other particular financing, you might be expected to get a hold of no less than step 3% of one’s purchase price to possess a down payment, however the USDA program has no need for it.

For folks who meet the requirements for it mortgage, a choice of devoid of to save a deposit is save you thousands of dollars, which help your move into your property without damaging the lender.

Borrowing Conditions

If you have had particular difficulties with their borrowing, getting home financing could be more out of problematic. The USDA system allows people with no finest borrowing from the bank to qualify.

Even although you have made late payments in earlier times, these may end up being overlooked for people who have not missed costs to possess an effective year. The underwriter can use repayments to help you power otherwise cord organizations because the proof to demonstrate you have got a track record of and work out money into the date.

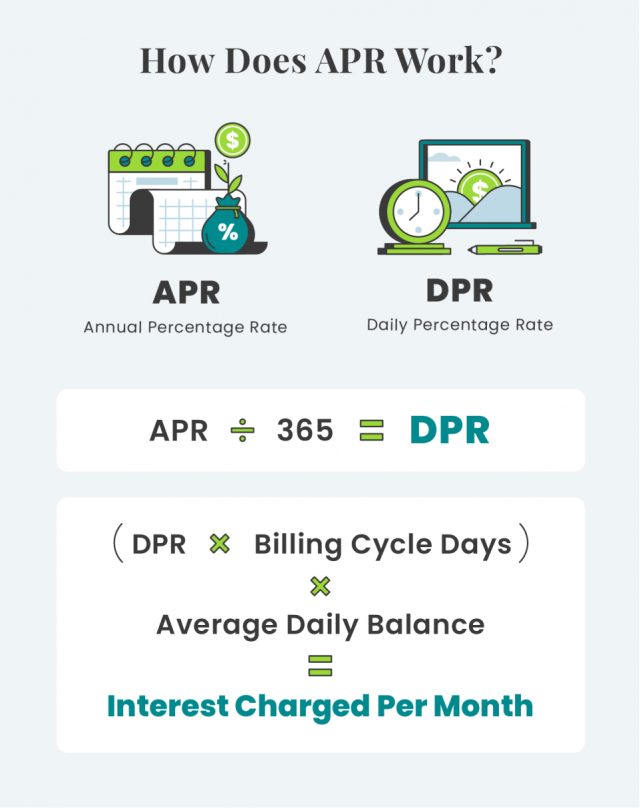

Competitive Fixed Pricing

Interest rates on USDA-guaranteed funds is actually comparable to antique otherwise FHA finance. This is why you will not end up being paying even more into the attention than other kinds of loans even if you was benefiting from the new gurus offered by brand new USDA system.

No Individual Mortgage Insurance

The latest USDA does not have a requirement to spend private financial insurance rates, but not, they are doing require you to pay other costs. While this is the same as personal financial insurance rates, it is always a lot cheaper.

You are investing more dos% from inside the home loan insurance rates when you’re approved to have loans in Sawpit a conventional financing. New FHA charges an initial fee of 1.75%, having monthly fees that would be 0.55% of the loan amount. In comparison, the brand new USDA means a-1% upfront percentage and you may 0.35% of one’s a fantastic equilibrium annually. The newest step 1% upfront percentage will be financed otherwise given out regarding pocket at closing.

Zero Mortgage Constraints

If you’re to find a home in Tx having fun with an effective USDA financing, you are not limited to a certain loan amount. What’s going to restrict you will be your income.

USDA fund are created for straight down and you can reasonable-money household, and they have limitation money quantity based on the number of somebody staying in our home. If for example the joint income exceeds its limits for the place, you won’t meet the requirements.

The USDA loan earnings restrictions are 115% of one’s average earnings in the condition. Such as, if you’re in Tx Condition (a rural city west of Houston) the amount of money restriction are $110,650 that have lower than 5 people in your house. When there will be four anyone or more, the latest restriction is $146,050. That it limitation is actually for 2024 and you can alter based on median income and you may location.

Purchasing Settlement costs

Even although you use the option of failing to pay a lower percentage, you’ve kept another type of highest upfront payment. Settlement costs will be a considerable costs which is together with owed when you purchase your house. not, and work out it more comfortable for customers, brand new USDA lets vendors to help you subscribe to assist pay these types of will set you back.