There is certainly a far greater capital selection for your residence advancements.

While you are scanning this, people most likely said how you can money your residence recovery is with a homes financing. Disappointed, however, to place it bluntly, you’ve been offered crappy information!

We become they; you prefer a fortune to make your home into the fantasy household, and you can build loans sound high because they will let you acquire in accordance with the worth of your residence following renovation try done.

Build money used to be the actual only real solution. up to RenoFi Finance.

Whether you talked into financial or a pal just who ran due to a comparable processes, they most likely didn’t mean so you can intentionally lead your about wrong recommendations, however, the present business has evolved from inside the an ideal way!

This is the reason it is sad a large number of people who ought not to use construction funds for their renovations nonetheless is, simply because they envision it is the only choice to own renovations.

Absolutely help improve right choice as to what best method to finance renovations, we will talk your because of exactly how design money performs, providing you with all the information that you need to make the correct conclusion regarding the investment your own recovery.

What exactly is a casing Financing?

- They might be fund for the intended purpose of building a home in the ground-upwards, you to definitely some individuals additionally use getting major home improvements too.

- He has a modern drawdown, and therefore your (or their contractor) receive the amount borrowed from inside the installments.

- They’ve been small-label funds you to definitely become a permanent home loan.

- These types of financing want refinancing, meaning you’ll need to lose any existing cost you locked from inside the.

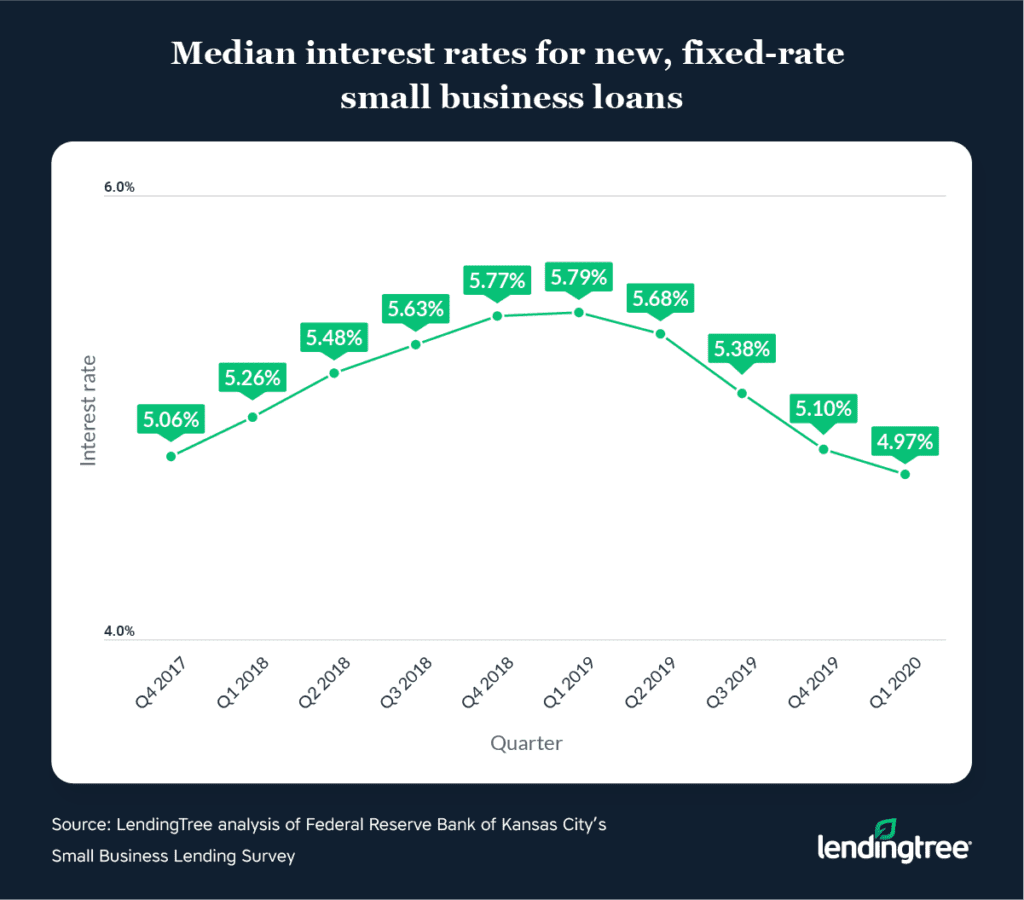

- They often times have large rates of interest & charges than old-fashioned mortgages.

Just how can Build Funds Functions?

Build funds was basically never in the first place intended to be utilized because the an excellent way to financing renovations, as an alternative in order to change a plot of land to the a separate home. Something that, as might predict, sells loads of risk.

Therefore, an intricate gang of stringent standards are placed set up in order to cover the lender. Such same criteria should be followed of the whoever takes aside a construction mortgage, regardless of whether that’s to finance a remodel or another type of home design.

This is why there’s a lot a great deal more works with it because of the every events than just together with other version of household restoration funds.Actually, some of these conditions are generally as to the reasons of a lot designers dislike construction finance to possess renovations.

The main one enticing top-notch a construction mortgage ‘s the feature so you can use additional money centered on your home’s just after renovation really worth. However, a homes loan no longer is the only way to borrow on their home’s improved really worth.

Why Build Loans Aren’t your best option to possess Renovations

In advance of we discuss the this new financing possibilities, let us go through the about three reason a construction loan was not any longer the best choice out of financing for some recovery tactics:

step one. You are obligated to re-finance and you will spend much more.

Was basically you one of the happy individuals protected an enthusiastic extremely home loan rate when they had been at all-go out record downs? Digital highest five! Just after a sensible move in that way, you are probably not seeking quit, therefore never blame your.

Unfortunately, with a property financing, you happen to be required to re-finance your home, and thus losing experiencing the first-mortgage speed your attained when you look at the the procedure.

You happen to be refinancing into the a higher level.

Refinancing will often kill two birds which have one to stone; you get a much better speed while the money you need to loans Helena Alabama do your renovation. In case you recently refinanced, you do not have to go through the process once more and you will incur a whole lot more charges. If you don’t even worse, refinance into a high rate of interest.