There’s two crucial strategies lenders used to determine whether or not otherwise perhaps not a citizen can be be eligible for a home collateral financing, next home loan or line of credit. Basic, they check out the homeowner’s newest financial picture.

Lenders can certainly and you can effectively see a beneficial homeowner’s creditworthiness. not, there are still of many opportunities to improve on push-by the possessions appraisals, that can be used for non-GSE funds less than $400,000, including family security fund, credit lines and you can refinances.

The very best drawback off push-by valuations is that they can make assumptions regarding the interior of a home, that can trigger enhanced exposure or shorter chance of one another lenders and you will residents. By way of example, a force-of the assessment or research may overvalue a home where in actuality the indoor has actually signs and symptoms of deterioration past what can be expected toward residence’s many years. On the other hand, a house that was very carefully managed and you can up-to-date because of the its residents will be underrated. Regardless, an area-simply possessions position statement cannot usually give adequate sense and will result in a bad customers feel

The new valuation tech

Technology is with an adaptive influence on valuations guiding alternatives that do not want an appraiser otherwise studies enthusiast in order to go into the inside of a house or even go to the assets anyway. These the newest development will help expedite the new valuation process, remove origination will cost you, shed dangers and you can boost valuation reliability.

Alternatives are in reality offered that determine a home at level playing with uniform assessment research (UAD) conditions. These tools can certainly and rationally choose the overall status and you can quality of a property which aren’t usually acknowledged during the drive-because of the valuations.

Brilliant desktop vision technology otherwise wise picture detection are widely used to generate these type of valuation choices. With desktop sight, the clear answer is trained to extract information from graphic offer, and then take strategies according to research by the pointers. This technology has already been used regarding entire valuation techniques, in addition to to have investigation collection, report-strengthening and quality control.

Throughout the study range process, desktop vision possibilities proactively and you may automatically name and you may validate photographs and you can extract property have off those people photographs. The technology may also identify damage or solutions to be certain these people were addressed for the an assessment or valuation report.

To possess appraisal otherwise valuation report manufacturing, computer eyes can be choose a topic property’s framework style, updates and you can high quality in order to accelerate new comparables-choice processes. Rather than being required to dig through images out-of a swimming pool from similar sales, desktop vision instantly describes possess which are often arranged and you can blocked to help you rather automate the process, while keeping objectivity and you will trustworthiness from the analysis.

Along with the latest QA processes, computer sight double inspections new property’s high quality and you can updates, validates most of the correct photo have been drawn, assists regarding reconciliation out of related provides and more

Examine ?

Validate, a separate service supplied by Ice Mortgage Tech, leverages computer system vision tech, along with other smart research and statistics enjoys, to greatly help would transparent, legitimate, mission and you can reputable valuations for the majority of financing fool around with cases, including family security financing https://paydayloansconnecticut.com/north-grosvenor-dale/, credit lines and you may refinances.

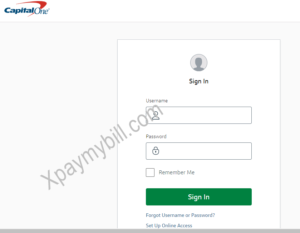

The brand new borrower have access to Validate through a contact or text hook up sent by the lender or in direct the borrowed funds application. Following a number of easy encourages, the newest debtor requires certain images of its house for the a safe and you can regulated techniques, where just the cam on the equipment normally gather the knowledge. The new compiled info is monitored and you can filed with the location properties to the borrower’s smart phone. That it whole process requires less time doing versus debtor locating and you may uploading the economic documents due to their loan application.

Immediately after determining the fresh new property’s position and you will high quality, Verify measures up they with similar residential property to manufacture a disorder-modified worthy of imagine. House security is actually calculated from the deducting one a fantastic financial liens, due to the fact known in ICE’s public information research. As well as submission genuine-time possessions photographs, the latest citizen completes a preliminary survey one to verifies personal checklist analysis.

Brand new resident is also capable overview of one assets-value-improving places and you can called for fixes. Lenders located efficiency owing to an integral API or a concise PDF report. The lender can choose to make use of Validate’s automatic valuation model (AVM) as the a separate valuation or admission the information range on their traditional valuation-functions supplier for further research.

Removing subjectivity

10 different appraisers you will render property 10 various other valuations. From the leveraging technology for the job, we have been boosting studies texture if you’re helping promote a legitimate, mission and you may credible property value. And you can what currently takes months or prolonged playing with old-fashioned tips, Verify can be submit in just minutes.

John Holbrook, Vice-president, Digital Valuation Solutions within Ice Fixed-income & Studies Features has actually more than twenty eight years of knowledge of guarantee exposure and you will valuation, having kept certain roles as the a keen appraiser, USPAP instructor and you may strategic positions on LPS, Federal national mortgage association, Equity Statistics and you will Black Knight.