- your lawfully very own your new household and certainly will move in.

Your own conveyancer often sign in an appropriate fees on the domestic getting you. They will certainly also register another type of judge fees for the home loan financial.

An equity mortgage are secure against your residence in the same method a fees home loan is. This means that if you do not match payments, you are vulnerable to dropping your house.

Brand new court costs will be recorded which have HM Belongings Registry and you may would be shown with the identity deeds (control documents) for your home. The fresh judge costs will not be removed unless you have repaid from your own guarantee loan and your payment financial.

Your house tends to be repossessed unless you continue repayments on your own installment mortgage, equity financing or any other fund protected against your home. Consider bringing independent financial suggestions before you make any economic decisions.

Collateral mortgage officer

- establish the Lead Debit to invest the new ?step one monthly government percentage

- plan for one shell out charges and desire repayments in your guarantee financing (after the earliest five years)

- help you if you’d like to pay-off certain otherwise all of the of your own security mortgage

- make it easier to if you wish to make modifications into payday loans Niantic the guarantee mortgage membership.

Once you’ve traded deals, you might have to spend costs for individuals who change your notice on buying the domestic.

Paying down your own collateral loan

- the fresh new equity financing identity finishes

- you only pay out-of your cost mortgage

- your promote your property

- we ask you to repay the loan completely (if you have perhaps not remaining with the standards of one’s collateral financing offer).

You simply cannot create regular monthly payments for the paying the new security mortgage. not, you could pay off any guarantee financing, otherwise create region costs, at any time. If you’d like to do that, contact brand new security mortgage officer.

When you repay particular or your guarantee mortgage, extent you only pay try worked out because a portion off the market industry worthy of during the time.

If your ount you must pay back. Of course the worth of your residence falls, the quantity you pay along with falls.

Workout what you need to repay

You might repay all of the or element of your security mortgage when. You can make part costs of at least 10% of your own full fees amount, considering exacltly what the residence is really worth during the time, to attenuate how much cash you borrowed.

On precisely how to create a payment, we have to be aware of the current market value of your residence. Make an effort to rating a royal Institution out of Chartered Surveyors (RICS ) valuation report away from a professional surveyor who’s projected the importance of your property, predicated on the reputation and also the most recent housing marketplace.

When you’re paying off the full collateral financing immediately after promoting their home, the amount you pay depends with the:

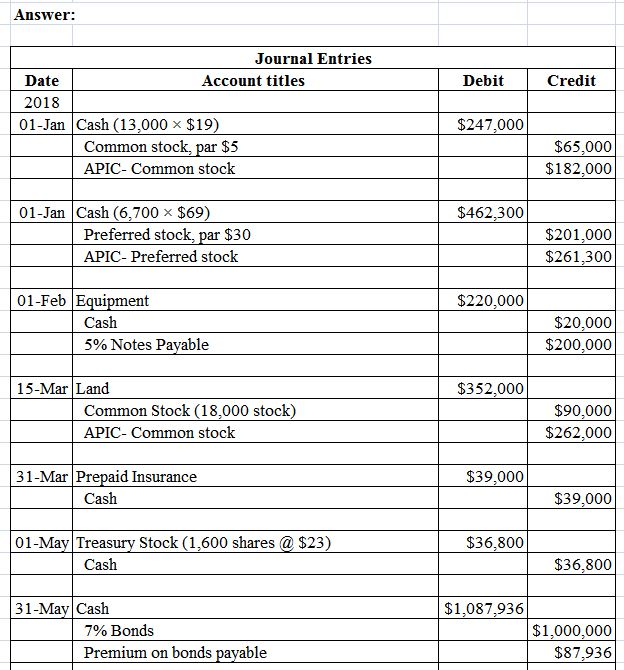

Understanding their attention money

the help to invest in: Security Amount borrowed (price x collateral mortgage commission). The latest equity loan payment wil dramatically reduce pursuing the one area installment

by the rate of interest (in the first year this is exactly step 1.75% of security loan amount you owe). The rate develops on a yearly basis by the addition of CPI and additionally 2%. The rate regarding the prior year is then always work-out the speed go up for the next 12 months.

How we work-out interest rate increases

Rates of interest go up every year inside the April by User Rates List (CPI), including 2%. The latest desk below suggests the interest increase try has worked out.