When you begin the homebuying excursion, you’re deal with particular very signifigant amounts. For the majority Pros, those people wide variety can be a bit overwhelming.

Talking-to a good Va financial concerning your mortgage affordability is always an intelligent first step inside the homebuying procedure. However, strong units are present that take away the concern with to shop for property you can’t pay for, and you may performing this will provide you with an authentic notion of exactly how far Virtual assistant home loan you really can afford.

To qualify for a home loan that fits your personal and you can financial needs, enter in your data to choose exactly how much household you really can afford using this easy Virtual assistant loan cost calculator.

Just what Circumstances Decide how Much Home You can afford That have good Va Mortgage

Since an experienced, you will get the means to access one particular strong mortgage equipment payday loan North La Junta currently available – the brand new Virtual assistant home loan, as there are a level of solace into the focusing on how much house you can afford.

But, being qualified for an effective Va financing does not be certain that you’re going to get a home loan otherwise purchase a property you might conveniently easily fit into your budget. Thus, let us see about three crucial section that foundation into the brand new computation out-of Va mortgage cost.

Money

Your own revenues will be your overall shell out prior to write-offs and helps decides how much house you really can afford. Unless you can pay for property in bucks, you will need a steady income and make their month-to-month mortgage payments.

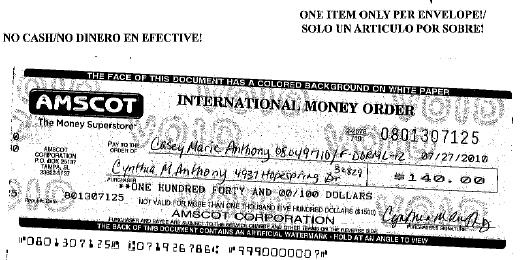

Lenders should ensure money giving duplicates of the W-2’s, pay stubs, 1099s, handicap prize letters, proof of worry about-employment and much more.

Loans Costs

Your full month-to-month loans money plus enjoy a serious part from inside the household affordability. In summary the greater number of month-to-month debt Pros carry, the latest more complicated it is so they are able shell out their costs easily.

The debt-to-earnings proportion (DTI) allows you to learn much more about your own overall month-to-month personal debt and family value, and therefore we are going to cover in detail after.

Credit history

VA-recognized mortgage loans don’t have any minimal credit history requirements. But not, with a lower credit score, it is possible to spend a higher rate of interest and fees that will improve your monthly mortgage payment.

Loan providers make use of credit score to check your own level of economic responsibility. More financially responsible youre, the more likely youre and work out their home loan repayments towards the time.

When you yourself have quicker-than-primary borrowing, lenders you will consider your a great riskier borrower and you may charge you a whole lot more to own a home loan.

Why Their DTI Is very important to own Affordability

Your debt-to-earnings proportion is the relationships between the earnings and just how much spent every month to your personal debt. Like, in case your full monthly loans try $720 along with your month-to-month money is actually $dos,one hundred thousand, your DTI will be thirty-six percent.

Complete month-to-month debt (lease + vehicle payment + credit card commission + education loan percentage) / Terrible monthly income = Debt-to-income proportion ($1,200 overall obligations / $cuatro,500 gross income = 0.twenty six or twenty six per cent).

Keep in mind most Virtual assistant loan providers just use productive user expense that demonstrate up on your credit report in order to assess the overall monthly obligations. In just about every case, VA-supported loan providers would not have fun with financial obligation just like your cellular phone bill, automobile insurance, health insurance advanced otherwise power bills so you’re able to estimate your DTI.

The brand new Va advises one loan providers cap your DTI from the 41 percent. But not, new Virtual assistant doesn’t supply the actual financing, so it’s up to lenders to make use of their unique percentages so you’re able to create finance.

In the event your DTI is higher than 41 per cent, you could pay increased interest otherwise spend more fees. By paying over 41 percent of gross income on the month-to-month financial obligation, a little down move on your shell out you may really damage their long-title property funds.

Difference in Top-Avoid and you can Straight back-Avoid DTI

You really have heard of the new terms front side-prevent and you may straight back-stop debt-to-earnings ratios. However,, you do not understand the difference in the two as well as how they perception their DTI formula.

The side-prevent DTI can be your housing expenses, like your monthly payment, property taxes and you may homeowners insurance separated by the earnings.

No matter if loan providers avoid so it proportion so you can meet the requirements your, it’s still essential in letting you work out how much home you really can afford.

A broad rule of thumb can be your front-avoid DTI cannot exceed twenty eight-30 %. Even though this laws actually invest stone, it is an excellent benchmark to assess your Virtual assistant house mortgage affordability.

The back-stop DTI ratio calculates how much cash of the revenues goes into other sorts of financial obligation particularly playing cards, student loans and you can auto loans. A before-end ratio not as much as thirty-six % tends to be well-known, however, this may are different with regards to the financial.

Why Rating Preapproved to suit your Va Mortgage

Whether you are provided a great Va mortgage, antique mortgage, USDA mortgage or an FHA financing, providing preapproved is a big milestone on your homebuying journey.

A great Virtual assistant financing preapproval try a loan provider suggesting simply how much investment you qualify for. Regarding the housing market, a great preapproval reveals agents and you can providers you have got big to purchase stamina. Acquiring your own Va financing preapproval just before household-browse can also make you a much better idea of just what groups of houses you really can afford.

To locate a good Va financing preapproval, you’ll want to render lenders having documents of a career records, army service, or other necessary data to decide the qualifications. Loan providers will likely then require your own permission to pull your own credit score.

Should your credit rating meets the newest lender’s criteria, you will then provide proof income or other pertinent files created on your current financial situation. Documents you will were lender statements, W-2s, disability honor emails plus.