Ease Your debt Today

Are you currently behind in your month-to-month mortgage repayments and you can concerned with foreclosure? Depending on the products, that loan modification may be an appropriate solution to help you go far-called for recovery. In the place of losing your residence owing to foreclosure, short revenue, otherwise personal bankruptcy, you happen to be capable renegotiate new regards to your own home loan to raised match your financial situation.

On Alb of Jacksonville loan modification solicitors has actually helped a lot of members through the Jacksonville in addition to encompassing components keep their houses using mortgage loan modification. With made a good 10.0 Superb Avvo Rating and you will an intensive distinctive line of confident consumer feedback, we can assist you action-by-action from the associated legal procedure since the fast and you will effectively just like the it is possible to, ensuring that the legal rights are safe all the time. Talk about the debt-save choice in full throughout a free of charge situation investigations.

How does Mortgage loan modification Performs?

The entire process of loan modification pertains to negotiating together with your financial to change the terms of your own mortgage in order to secure a more affordable monthly payment. As a result of deals, you happen to be able to change loads of your loan’s terminology, including:

- Cutting your interest rate

- Reducing your monthly premiums

- Lowering your dominant harmony

- Extending the latest cost several months

- Counting overdue repayments toward the entire amount borrowed

Since the foreclosures processes is costly having loan providers, occasionally, banks and you will lending institutions is interested in staying consumers in their house less than altered terms. This course of action should be tricky, but not, therefore it is vital that you keep up with the recommendations and you can coverage off an experienced loan modification lawyer right away. All of our knowledgeable lawyers know what to say, exactly who to talk to, and and therefore actions could be strongest so you can work out an appealing arrangement.

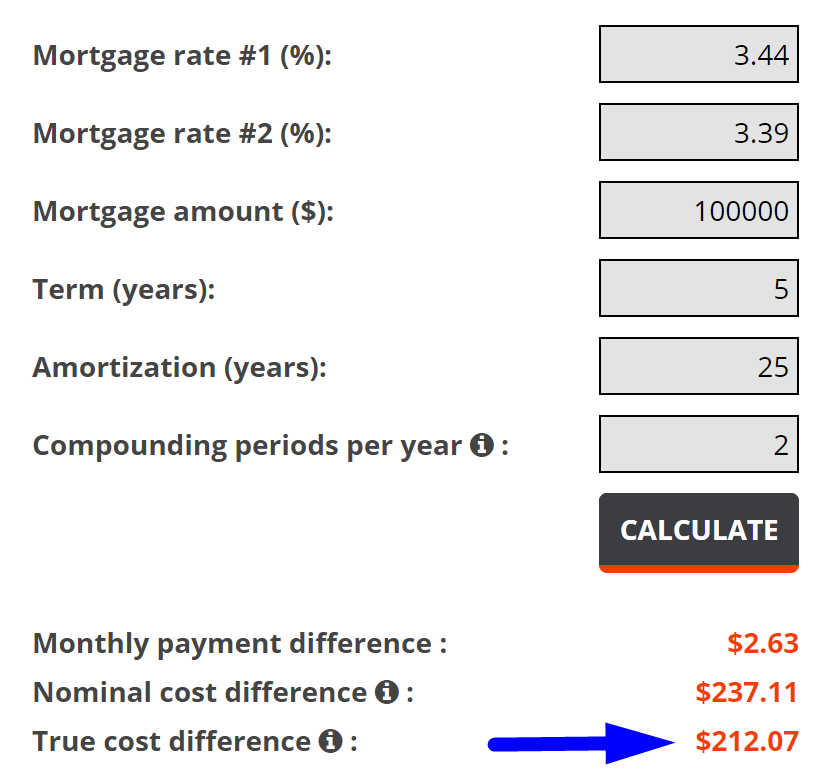

As well as blocking foreclosure and you will providing you with more hours to pay off your home loan, a loan modification ount you borrowed from. You’re capable discuss a decrease in the notice price and even the main number due. Some borrowers have the ability to cut hundreds or thousands of dollars 1 month. Getting a normal 31-year mortgage, a reduced amount of even just a few hundred cash are worth tens and thousands of dollars inside offers along the longevity of the mortgage.

Being qualified having Mortgage loan modification

That loan amendment may be readily available for people borrower who’s not able to make monthly mortgage payments. Affairs that improve chances of a loan modification are available include:

- The total amount remaining towards financial exceeds the value of the property

- The borrowed funds interest rate is adjustable

- The loan rates is very high

- New borrower was feeling high pecuniary hardship, for example, because of earnings losses otherwise unexpected scientific expenses

- New debtor features sufficient earnings to pay for modified monthly payments

The home loan terms commonly set in stone, and you will quite a few of lenders are available to the potential https://paydayloanalabama.com/monroeville/ for a beneficial loan modification. There is no need to help you rely on the fresh goodwill of the financial, updates alone. Authorities applications remind loan providers supply loan adjustment. Talk to a talented mortgage loan modification lawyer to go over your options to possess debt relief and how to built the strongest bid to own a modification to your home financial.

Take care of the Effective Give you support You need

Whenever homeowners like to leave legal signal and try to manage her home loan modification dealings, lenders will get often see them as easy targets and you will push terms that aren’t inside their needs. With our Jacksonville home loan amendment attorneys on your side, you can top the brand new playground and you may rest easy understanding that their liberties due to the fact a customer try safe. With more than 70 several years of mutual courtroom feel, we are able to make it easier to understand your own courtroom possibilities and you can discuss an enthusiastic plan one to best suits your financial need.

Financial Help you Is Have confidence in Jacksonville

Whenever you are enduring the mortgage repayments and seeking to have choices to reduce your obligations, telephone call the new Jacksonville home mortgage and you may debt settlement attorneys in the Albaugh Attorney to possess devoted and you can caring legal help. I satisfaction our selves on the delivering personalized, effective, and energetic service to our Florida customers seeking monetary independence and you can safety. Name the fresh new Florida debt settlement lawyer in the Albaugh Attorney today in the 904-471-3434 and let’s help you work towards a brighter financial future.