Customers thinking of buying a fixer-higher domestic must look into an excellent FHA 203(k) loan. New FHA 203(k) loan program is made especially for fixer-top qualities, and certainly will promote homeowners …

Buyers thinking of buying a beneficial fixer-higher household should think about an excellent FHA 203(k) mortgage. This new FHA 203(k) loan system was made especially for fixer-upper properties, and will give homeowners with more money to fix in the household as well as the buy pricing. FHA 203(k) loans are good choices for consumers thinking of buying foreclosures functions, since foreclosures generally commonly relocate ready. For more with this, continue reading the next post off TheStreet.

To shop for an article of disappointed a property will likely be good cure for snag an aspiration family in the a steep disregard. Nevertheless these homes are usually wanting fix to take her or him high tech. As the 1978, the newest Government Houses Administration’s (FHA) 203(k) financial system might have been available for homebuyers who want to purchase and you will quickly redesign a property.

FHA 203(k) loans are for sale to all the holder-residents, it doesn’t matter if he or she is basic-day homebuyers, move-right up buyers otherwise property owners trying to refinance.

«FHA 203(k) money are the most effective-kept secret on the mortgage business,» states Susan Hairdresser, senior vice-president for new structure and res getting Wells Fargo Mortgage during the Marlton, Letter.J. «Users should probably learn about it window of opportunity for renovation financing since the the fresh money are not only to own foreclosures. You can use them into all types of attributes, also just an adult house that requires upgrading, consequently they are designed for one another orders and you will refinancing.»

Rick Sharga, manager vp from Carrington Mortgage Holdings inside Santa Ana, Calif., claims FHA 203(k) money will help solve some of the current issues from the housing marketplace.

«Discover many services inside the disrepair nowadays, a good amount of which aren’t even in the market while the he could be this kind of crappy figure,» states Sharga. «An enthusiastic FHA 203(k) you are going to ensure it is a proprietor-occupant to order property and you can remedy it up, which could reduce the depreciation in the business. Today, only dealers try buying these types of features and are also to acquire with dollars at lowest you are able to rate.»

Sue Pullen, vice-president and you may older financial advisor to own Fairway Separate Home loan from inside the Tucson, Ariz., states FHA 203(k) finance had been lesser known whenever household collateral money was offered. However, she adds one to, he’s advisable getting the current industry.

Was Gemini Today! 123

The Gemini Replace makes it easy to analyze crypto industry, buy bitcoin or any other cryptos and additionally secure To 8.05% APY!

FHA 203(k) possibilities

The fresh smooth FHA 203(k) is bound so you’re able to all in all, $35,100000 property value repairs, no lowest fix requirements, Pullen says. Solutions for both simple and you will streamline fund must start contained in this 29 times of the brand new closing and may be complete within six months.

«New improve loan constraints the sorts of repairs to nonstructural home improvements and you will nonluxury facts, you cannot create a swimming pool or circulate structure,» states https://clickcashadvance.com/payday-loans-co/hudson Pullen. «This loan is great for replacing the fresh new Hvac or even the carpeting, replacing the products or the windows.»

The quality FHA 203(k) allows for structural fixes, demands at least $5,100 regarding renovations and have need a beneficial HUD agent to watch the newest home improvements.

FHA 203(k) criteria

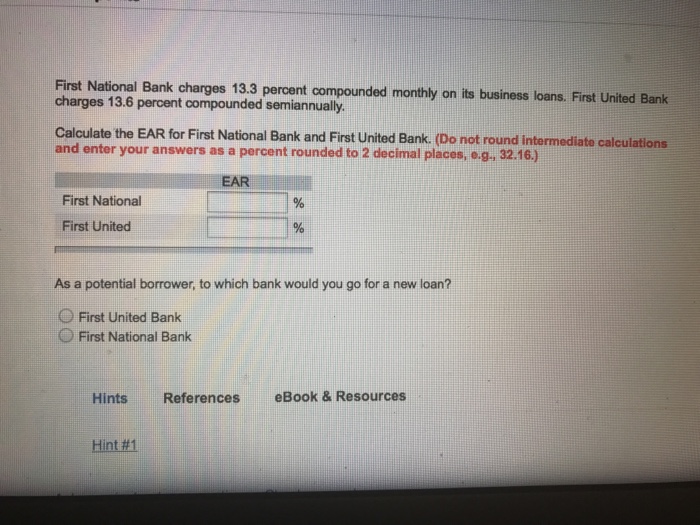

As with all FHA loans, consumers need make a down-payment out of step 3.5 % and you will shell out home loan insurance costs. Consumers have to be eligible for an entire loan amount, such as the cost therefore the restoration will cost you, with requirements just like the individuals set by other FHA lenders. Instance conditions become a credit score of at least 620 and you will a financial obligation-to-earnings ratio out of 41 % in order to 45 per cent.

Pullen appetite consumers to do business with a loan provider experienced with FHA 203(k) fund, while the laws concerning the repair performs and you may appraisals should be used.

«An enthusiastic FHA 203(k) loan requires the customers and also make a deal to your a property following to get at the very least you to bid, but sometimes a couple of estimates, away from a contractor on repair can cost you,» says Pullen. «How many estimates required can be the lending company. Very, like, for many who place a deal to the a home at the $a hundred,000 in addition to builder estimates on the solutions that you like was $20,100000, you’ll want to qualify for the loan while making an all the way down fee considering a good $120,one hundred thousand loan.»

Mortgage lenders experienced with FHA 203(k) funds can suggest multiple designers who are have worked into loan program just before. Pullen claims that most financial people require designers becoming registered positives to make sure quality renovations.

Appraisal and you will costs

Simultaneously, states Sharga, the lender will require an appraisal of current household worthy of together with as the-repaired well worth, that’s in line with the projected property value the home advancements. The borrowed funds matter depends to your as-fixed well worth.

Brand new charges getting an FHA 203(k) loan try some more than getting a traditional FHA home loan, says Pullen. Such costs include an extra payment regarding $350 otherwise step one.5 percent of price of repairs, almost any try highest, which will be covered on the loan. Once repair efforts are done, requirements require a supplementary evaluation and you may label plan inform in order to make certain zero liens had been recorded. Pullen rates that the most charges mediocre out-of $five hundred so you’re able to $800.

Traditional repair and you will capital money

Conventional recovery and you may resource loans are around for proprietor-occupants, customers away from next residential property and you can traders, but these funds usually require a down-payment away from 25 % or even more and you may a higher credit rating than what becomes necessary from the very FHA loan providers.

«Individuals just who believe they wish to make use of the FHA 203(k) mortgage program is ask the Agent in addition to their bank if they are familiar with they and to assist them to decide if it is a great choice for her or him,» says Sharga.