Our mission is to give you the systems and you may depend on you need certainly to replace your money. Although we discover payment from our lover lenders, whom we will usually identify, all the feedback are our own. Reputable Functions, Inc. NMLS # 1681276, try described right here as «Reliable.»

PNC Financial is dependent in 1852, and now works much more than simply 19 states which will be one of one’s biggest loan providers in america. PNC now offers a variety of banking functions, and student financing, offering students a competitive individual replacement for traditional federal student loans. PNC was invested in bringing expert provider and you can fair terminology in order to its people and you may individuals.

Type of PNC Student education loans

PNC also provides borrowing possibilities getting numerous spends. Finance can go towards undergraduate, graduate, health and medical doctor college or university training as well as to cover costs throughout the health care provider residency and you can thinking into the bar exam.

PNC Student loan Programs

- Student Money These types of financing are offered for children enlisted no less than half time into the a keen undergraduate program. Individuals are able to use loans to pay for one bills obtain while you are seeking their education, also university fees, guides, supplies, or room and panel.

- Scholar Finance For college students signed up for a scholar or elite system at the least half-go out.

- Health insurance and Medical professional Fund To possess undergraduate and you will scholar consumers enrolled at least half of-time in a healthcare community system.

- Health Residency Funds For college students engaging in an approved MD, DDS, Perform, or DVM residence programs, otherwise going to within the next seasons, to greatly help pay for the expense of moving and just about every other obtain expenditures.

- Club Analysis Finance To own graduates otherwise latest people booked to help you graduate within the next six months regarding PNC-recognized legislation colleges attending do the pub test no after than just six months after graduation. Money costs, creating categories, and you will content.

Education loan Pricing

Funds come within each other repaired and you can variable interest levels. PNC’s varying rate fund start from step three.47% so you can %, in addition to their fixed price financing range between six.49% to help you % (APRs tend to be automobile debit and commitment coupons where readily available). Individuals features up to 15 years having installment and will bring benefit of pros including percentage deferment, loans forgiveness up on the latest loss of this new debtor, and you may elective co-signer launch after forty-eight days off timely money visit site.

Borrower Qualification

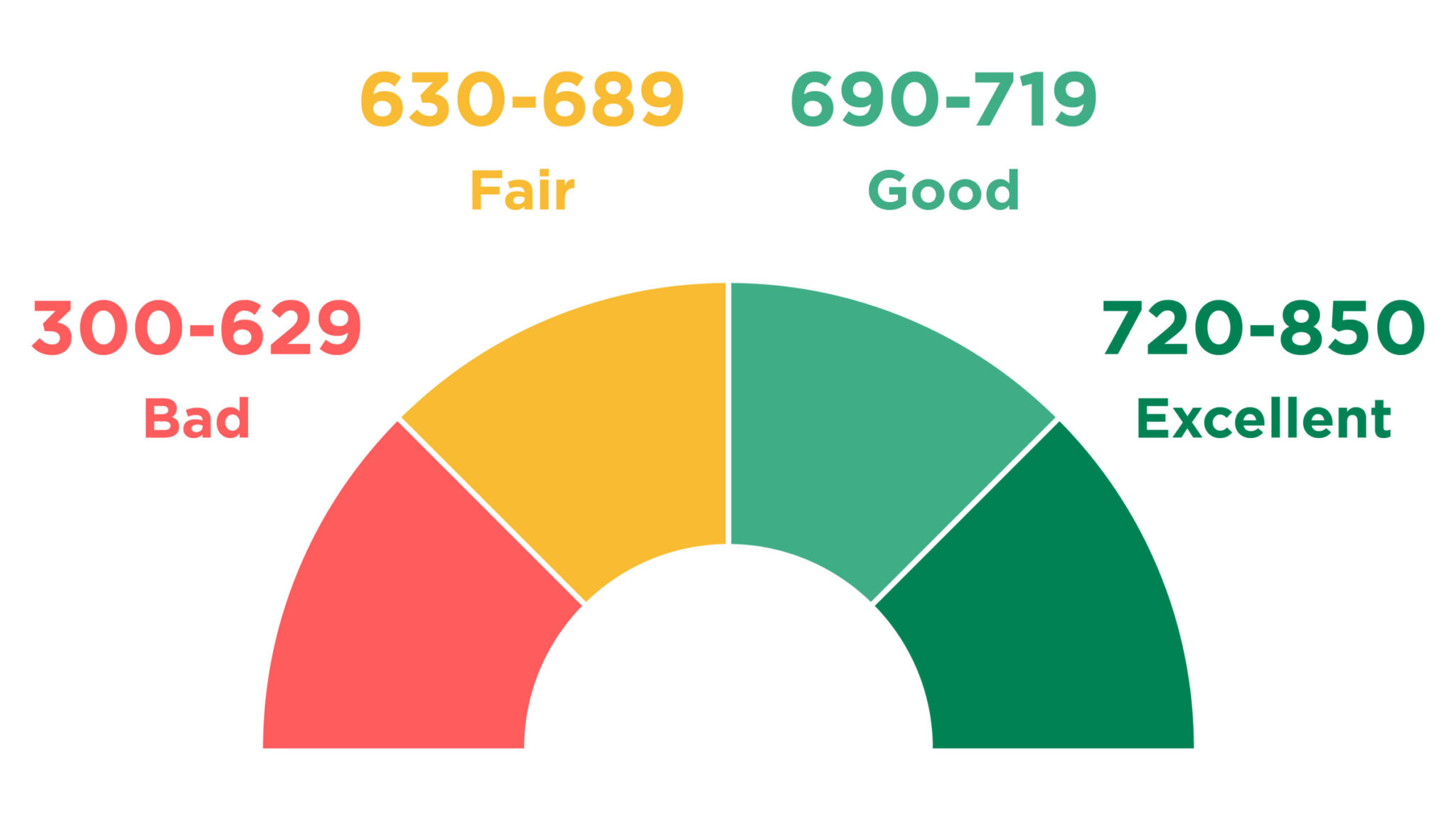

Individuals should be Americans or permanent customers and ready to meet related borrowing guidelines. When you look at the app procedure, the latest applicant will have to tell you evidence of 24 months out of high enough creditworthiness and continuing earnings otherwise a career records. College students struggling to fulfill such threshold conditions should think about adding a great co-signer just who suits these tips.

Borrower Positives

Individuals can pick ranging from around three fees alternatives: complete deferral (to 5 years whilst in university), appeal merely repayments whilst in university, and you may instant cost possibilities. Likewise, consumers whom create automatic money off their checking otherwise savings account rating an extra 0.50% interest rate deduction. Particularly government fund, PNC allows a beneficial 6-week sophistication several months pursuing the graduation, when borrowers do not need to make payments on their student education loans. Fundamentally, PNC does not charge software otherwise origination costs, and you can borrowers is discover a primary choice in just a matter of minutes.

Whom will be take out a student-based loan having PNC?

PNC private figuratively speaking are fantastic alternatives for creditworthy borrowers and you may college students who are in need of a lot more educational funding. PNC finance promote accredited borrowers aggressive costs and you will words, flexible repayment possibilities, commission deferment to possess half a year immediately following graduation, and you will student loans having both varying and you may repaired rates. PNC’s app techniques is not difficult and you can free.

PNC Education loan Analysis

Really evaluations on the internet work with PNC when it comes to antique financial strategies, rather than since a student-based loan lender. Extremely product reviews off PNC figuratively speaking state that their product was rather competitive that’s recommended for those in need of assistance out of more capital for their degree.

The purpose of the newest Reputable editorial writers and you may staff will be to assist all of our clients get up to help you rates on points encompassing beginner financing, mortgage, and private finance, to create advised behavior. The audience is right here in order to stay on top of the most recent development, trend, concepts, and you may alterations in coverage and you will laws.