Downpayment and you may closure rates guidelines software also may help lower the new initial will set you back of shopping for a property. These apps are very different by the location, very check with your state houses company observe that which you would be entitled to.

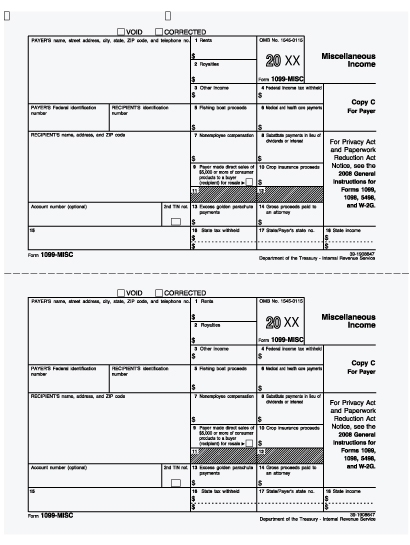

Freddie Mac computer are versatile in the way your own downpayment along with your money was acquired. Money shall be regarding antique W-2 money otherwise contracted 1099 income (though you will need a tax transcript to file which). Recall: The funds of the many borrowers into the financing is noticed, if you bring in a co-borrower, their earnings could well be taken into account too. The cash limit is for new household’s full joint earnings.

If you intend to own anybody rent a space otherwise part of the house away from you, it is possible to make use of your upcoming leasing money to help you qualify you into mortgage. To accomplish this, the newest tenant can’t be into home loan, must have lived to you for around one year, and should not be your companion otherwise domestic lover. You will additionally need to render records from repaid book to the history 12 months.

For down repayments, consumers are able to use a variety of sources of financing, and dollars, presents out-of friends, manager recommendations programs, advance payment recommendations money, as well as work collateral, that is once you truly improve the family and increase their worth (unlike an actual downpayment).

What’s Freddie Mac House You’ll be able to?

Family You can was a mortgage system backed by Freddie Mac. The loan is perfect for lowest-earnings consumers and you may first-go out homebuyers without much discounts. Being qualified buyers you desire simply an effective step 3% down-payment to use the loan.

Does Freddie Mac Home It is possible to make it boarder income?

Yes, you are able to boarder money – and/or coming money you expect away from a renter from the domestic – to help you be eligible for a house It is possible to mortgage. There are certain legislation out of which, plus the renter need lived to you for at least a year just before your purchase of the home. However they cannot be your spouse or domestic spouse, and need certainly to promote records out of reduced rent to possess for the past 12 months.

How can i sign up for Freddie Mac’s House You’ll Advantage?

To apply for a Freddie Mac Domestic You can easily mortgage, you will have to get a hold of a mortgage lender that gives antique finance, and fill out the app. You will have to commit to a credit score assessment and you will provide variations off monetary files (your bank enables you to know precisely those).

The majority of large banks, borrowing from the bank unions, and you will lenders offer traditional finance, along with Household You can mortgage loans, but make sure you check around for your very own. Rates of interest may differ generally from a single to a higher. Taking rates out of a number of additional companies is allow you to get the least expensive homeloan payment you can.

Is actually Freddie Mac Home Easy for earliest-big date homebuyers?

First-go out homebuyers can definitely use the Freddie Mac Home Possible loan americash loans Irondale, if they meet with the program’s income conditions. To help you meet the requirements, all your family members need certainly to make 80% or less than the area median family money. Freddie Mac computer keeps an eligibility product you need to use to decide this tolerance in your area.

If you intend to use the Home You’ll be able to mortgage since the an initial-time client, you will need to complete a good homeownership knowledge way very first. Freddie Mac demands that it in the event that all of the consumers to the loan often become very first-date homeowners.

What exactly is a beneficial Freddie Mac Domestic Possible mortgage?

A good Freddie Mac House It is possible to financing was home financing having homeowners having lowest incomes or little during the discounts. Permits getting a good step 3% down-payment, and you will financial insurance is cancelable after you’ve at least 20% collateral home.