Just like the environment risk goes up, organizations of all the groups have so you can added alot more of its costs to help you get yourself ready for and you will responding to calamities. Committing to exposure administration will help offset these types of can cost you, but the majority of companies, instance small businesses, may not have the fresh monetary liberty to do it. Inside , the fresh new article writers surveyed 273 companies affected by Hurricane Harvey (and you can analyzed the credit account of five,000) just after they hit Southeast Texas in 2017 to see the way they replied. With this specific analysis, the newest experts shed light on brand new a lot of time-identity ramifications regarding calamities getting enterprises, and you may share coaching to own policymakers and business owners about precisely how top to prepare businesses to own future exposure.

To deal with expanding weather dangers, enterprises would have to reserved an increasing share of the bucks flows. Hurricanes, wildfires, in addition to rise in water accounts enforce can cost you on firms, in preparation and you can a reaction to these types of calamities. Due to the fact risks expand, men and women costs are simply gonna increase through the years.

Exposure government might help get rid of the expense of weather alter. Strong risk government tips layer financing products – insurance, reserving, and borrowing from the bank – to address different aspects of your risk. Doing so facilitates data recovery giving enterprises the funds they need whenever crisis effects.

However, committing to risk management and additionally imposes instant will cost you. Insurance coverage demands upfront advanced payments. Bucks 1000 loan supplies want staying financing booked to possess a wet date. Likely to finance repairs with credit requires companies to keep monetary independency – keeping enough slack within their cash to access financing into the the long term.

This means that, cash-secured companies are unable to to alter. Home business in particular often run on thin margins, hustling to pay for big date-to-date expenses such as for instance to purchase inventory otherwise fulfilling payroll. Of several do not getting he’s the true luxury so you’re able to invest resources to help you risk administration. But without one, enterprises get face extra challenges that create data recovery more costly about aftermath off a shock.

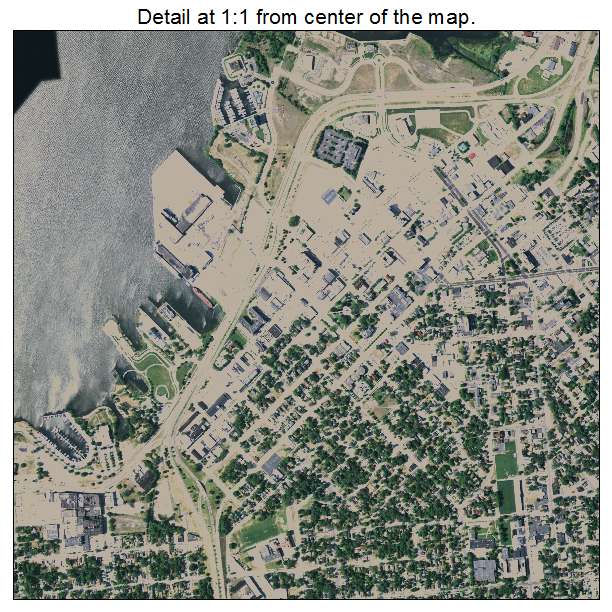

To explore these types of dynamics, we examined how Hurricane Harvey inspired enterprises immediately after they struck The southern part of Tx inside the 2017. Harvey is the most expensive experiences – causing $125 mil into the economic damages – regarding the most costly emergency year to the U.S. when you look at the five years. Environment researchers guess that violent storm was about 29% more severe on account of environment change, so it’s a typical example of how the dangers of severe storms are expanding.

The content

In , roughly 12 months immediately following Harvey, i surveyed 273 businesses regarding area affected – effectively out of deeper Houston in order to Corpus Christi on the Gulf Coastline. Interviewed firms was basically similar in the years and dimensions with other firms in your neighborhood. All of our survey asked detail by detail questions about any losses it obtain, how they covered him or her, and just how their recuperation was shifting.

To match the fresh new questionnaire, i examined the financing records of around 5,one hundred thousand organizations throughout the crisis urban area and compared the guidance to help you step three,000 organizations from all around the latest You.S. who have been not for the Harvey’s road. Because the questionnaire has the benefit of a broad sense of businesses’ event and you may data recovery steps, credit file give metrics commonly used by lenders, landlords, also provide chain partners, and others to evaluate the newest company’s economic health such as if it pays their expenses timely.

Exactly what Did Businesses Eliminate?

Our survey expected participants questions about its loss from Harvey. Enterprises advertised various difficulty, nevertheless the very striking have been funds losses. Almost ninety% away from surveyed enterprises reported shedding revenue on account of Harvey, mostly regarding the four-figure variety. Such money losings were as a result of staff disruptions, straight down buyers request, power outages, and/otherwise have chain points.

Fewer enterprises (on 40%) knowledgeable property injury to the building, machines, and/otherwise collection. While you are less common, assets wreck loss had been more costly normally than simply destroyed money. But not, assets destroy compounded the trouble away from lost revenue by keeping the newest organization signed: 27% with possessions damage signed for more than 1 month, and you can 17% closed for over 3 months. This is why, funds losses have been in the two times as large to own firms exactly who educated property damage.

Businesses’ credit reports after Harvey let you know signs and symptoms of stress too. Harvey caused many companies to-fall behind on the debt payments. Throughout the worst-overloaded portion, the newest storm enhanced unpaid stability of the 86% compared to its pre-Harvey profile. It impact is generally limited by quicker-name delinquencies (fewer than 3 months late); we do not look for a significant rise in loan non-payments otherwise bankruptcies. This trend more than likely reflects businesses’ ample jobs to stop defaulting towards their bills.

Just how Performed People Manage Cash and you will Property Losings?

An extensive risk administration approach usually uses insurance rates to help you import serious threats such as for example hurricane-relevant possessions damages. But insurance policies cannot defense some losses – along with funds losings on account of lower demand, worker disturbances, and supply strings factors. Borrowing from the bank address contact information moderate-seriousness losses; cash reserves address short-size losings. This layering are priple, carrying large dollars reserves has actually a big options rates. In addition, it demands upwards-front side thought and you can financial diligence.

Which superimposed exposure administration strategy – guaranteeing the major dangers, borrowing from the bank into the modest, and ultizing bucks toward quick – actually a good number of businesses did. Just fifteen% regarding interviewed enterprises impacted by so it listing-breaking hurricane acquired a fees of insurance policies. It low insurance coverage is due to enterprises are uninsured having flooding and you will breeze problems (age.g., they had insurance policies one omitted coverage for those perils) and/otherwise businesses insuring their property although not the cash exposures.

Borrowing plus played a small character: 27% out-of surveyed businesses used borrowing to invest in recovery. People often hadn’t was able sufficient financial autonomy in order to acquire immediately following the latest crisis, once the 50 % of people that applied for the newest borrowing from the bank was basically refused. Low-notice crisis money from the Small business Administration is the simply government recommendations offered straight to enterprises, but again, companies did not have the new profit are recognized. In total, singular-3rd out of interviewed companies which taken out a disaster financing were approved.