Everyone means help from time to time, exactly what if it help is more than just several hundred or so dollars, plus such an excellent $1500 mortgage?

You desire $1500 but not yes where to start? The good news is that we now have solutions, even if you need the money easily. When you get the mortgage you need, you could potentially make a plan like undertaking a cost savings funds to arrange on your own for future emergencies. Keep reading a variety of choices to have the financing you would like.

Assume you have not taken out financing before or you would like a beneficial refresher. If so, there are numerous official certification (along with an energetic savings account) you to definitely lenders tend to enquire about:

1. Your income

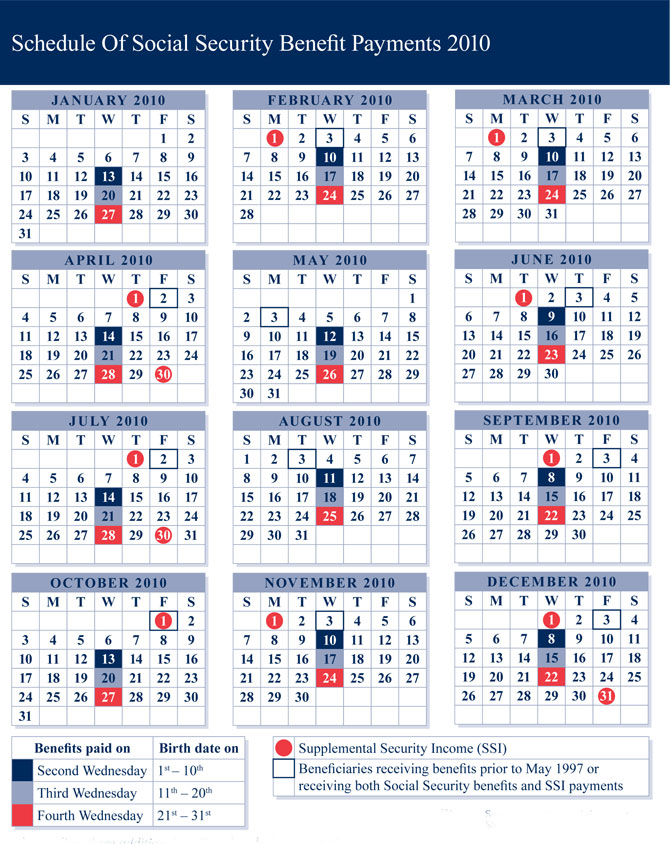

For most people, their earnings try regarding 1 day occupations. Yet not, choice types of money instance SSI, bargain work, and you will region-time really works are only a few examples to add whenever satisfying a full time income demands. Loan providers will have to remember to have sufficient earnings so you’re able to help make your mortgage repayments.

2. Ability to Generate Per Payment per month

In addition to income, loan providers often inquire about significant month-to-month costs like your book/mortgage payment or any other bills. This may provide them with a better notion of just how much you can afford.

step 3. Your Creditworthiness

Finally, your credit rating and credit rating should determine the kind of mortgage alternatives and you can lenders available. Particular loan providers can be open to lending to help you individuals which have worst borrowing from the bank records, while some might not.

Listed here are specific financing choice you can try based what your credit rating works out. Find out more about fico scores and their reviews to choose the group your belong.

Mortgage Alternatives When you yourself have a reasonable Credit score

The fantastic thing about which have reasonable credit is you have a tendency to have significantly more mortgage options to pick, and this not absolutely all individuals gets. As well, a good credit score setting you will get best mortgage terminology (much more about you to definitely lower than).

Signature loans

Unsecured loans are among the most used loan options available. With reasonable so you can advanced credit, there’s various consumer loan choices to think. A financial, borrowing from the bank commitment, otherwise a personal lender are typical financial institutions offering personal fund.

Signature loans can be used for all types of expensespared in order to harder fund, the borrowed funds app techniques is fairly brief. Shortly after acknowledged, the money are sent directly to your money.

Credit cards

Playing cards might be an alternative choice so you’re able to borrow money, for those who have a good credit score. Otherwise actually have credit cards to be used, below are a few mastercard has the benefit of having basic no or low interest rates pricing.

Payday loans

People decide to withdraw currency using the credit card. This is exactly described as a charge card pay day loan. The eye prices are sometimes greater than regular charge card orders. And, there is absolutely no elegance period to your attention, meaning it can begin to accrue quickly.

$1500 Finance if you have Bad a credit history

Even though you reduce than just prime credit history, you will find loan selection you can search to the. Here are a few them:

Less than perfect credit Unsecured loans

Specific loan providers work at personal bank loan alternatives for bad credit individuals. A consumer loan getting less than perfect credit records should be a protected or consumer loan choice (secured loans encompass guarantee, if you are unsecured do not).

Payday loan

A payday loan is actually an initial-title loan that is intended to be reduced by your 2nd pay check, and this title. Such loans appears like an effective way to get the money you want, especially if you you need him or her quickly. installment loan companies in Windsor IL Yet not, cash advance would be pricey, and also to pay the loan you happen to be expected to spend enough interest.