The means to access Straight down APRs: While full home loan rates have raised somewhat just like the 2022, the best HELOC pricing still tend to be lower as opposed to those from handmade cards

Homeownership, along with for people in the loanDepot, offers an important possibility to utilize the collateral obtained in the your quarters. One effective way to power it ownership risk is by using a domestic collateral personal line of credit (HELOC). In lieu of property security mortgage that give a lump sum initial, a HELOC lets visitors to acquire lower amounts as needed. So it versatile borrowing design ensures that some body only access the cash needed at a time, taking higher handle and you will efficiency from inside the managing financial requires. Whether to possess home improvements, training expenditures, and other financial requirements, a beneficial HELOC are going to be a handy and strategic solution to faucet on the guarantee manufactured in your residence.

HELOCs promote professionals including lower yearly fee pricing (APRs) versus handmade cards, the possibility so you can deduct focus money regarding fees, flexible distributions and repayments, while the capacity to boost your credit rating. not, you will need to think about the downsides also, for instance the access to your residence while the collateral, a reduction in your residence equity share, the possibility of rising rates of interest, and also the threat of accumulating a massive balance rapidly.

A HELOC provides a line of credit that one can use against if the you need comes up. Exactly like credit cards, HELOCs feature changeable interest rates, definition your own payment have a tendency to fluctuate with respect to the most recent notice speed therefore the loan amount at any given time.

Generally speaking, a great HELOC also provides a max credit limit in accordance with the equity you have got of your property. There is the option to utilize a share or every one of the line, and you can notice is actually charged simply on amount in reality lent. Thus, for people who haven’t made use of any personal line of credit, you’ll not are obligated to pay people principal or appeal.

Possible Tax Write-offs: This new Taxation Incisions and you will Operate Operate from 2017 didn’t dump the capability to deduct appeal paid off to your a house security line off borrowing (or household guarantee loan) if for example the fund are used for domestic home improvements. So you can qualify for so it deduction, the eye is employed to help you ‘buy, generate, or substantially help the taxpayer’s home you to secures the borrowed funds.’ There are specific thresholds and requirements to have deductibility, and you can itemizing deductions required.

Freedom in Credit: One of the first advantages of a good HELOC is the feature to make use of finance as required. Rather than household equity loans and personal financing that need you to sign up for a lump sum payment, a great HELOC enables you to obtain within the increments, providing you the brand new liberty so you can use simply what you wanted. This feature is specially beneficial in the event that specific price of good recovery or resolve are uncertain, because it makes it possible for smaller monthly premiums for those who become searching for lower than envisioned.

Fees Independence: HELOCs tend to bring autonomy in repayment options. The duration of your HELOC can differ according to number you intend to borrow plus the lender’s conditions. Brand new mark months, constantly lasting around 10 years, typically need only notice payments. But not, you might choose create dominant money as well to reduce the remainder equilibrium. As well, some HELOC loan providers today provide repaired-price choice, allowing pyday loans in Cuba you to secure a fraction of your debts during the a fixed interest getting a selected several months.

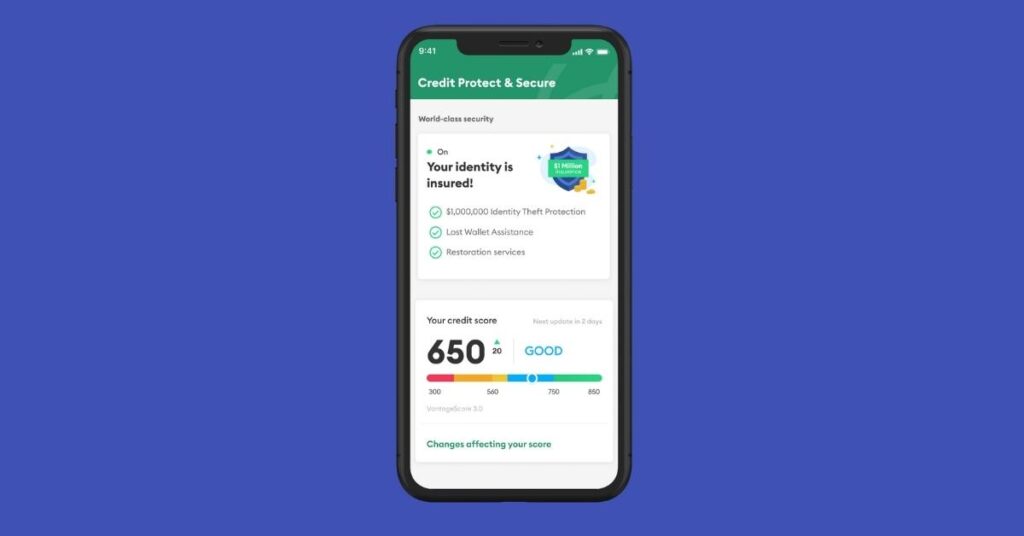

Possible Credit history Boost: Good HELOC normally definitely perception your credit score by indicating an excellent reputation for on the-some time regular monthly obligations

Both percentage history and borrowing from the bank blend are essential parts of their credit score, and sensibly handling a good HELOC can also be subscribe a far better borrowing profile.