You can’t obtain 100% of security with a beneficial HELOC. Very lenders will not enables you to go above 80% combined LTV (CLTV). CLTV matches LTV, but they products your own HELOC number into the formula including the mortgage matter.

2. Look at the borrowing from the bank

Just like the good HELOC was secured by the home’s collateral, it will be easier to get than many other type of unsecured points, such as for example signature loans. Although not, your credit score and you may credit history are still important, therefore need to qualify for their HELOC according to research by the lender’s standards.

These could may include you to definitely financial to another location, however, a credit score dependence on 620 otherwise most useful is common. Lenders also like to see a confident reputation of on-big date money and a good obligations-to-money ratio (DTI)-tend to forty% otherwise shorter.

Of many loan providers bring loan preapproval options. Based on in which your credit score really stands, you will find their has the benefit of and you can potential rates in place of harming your credit.

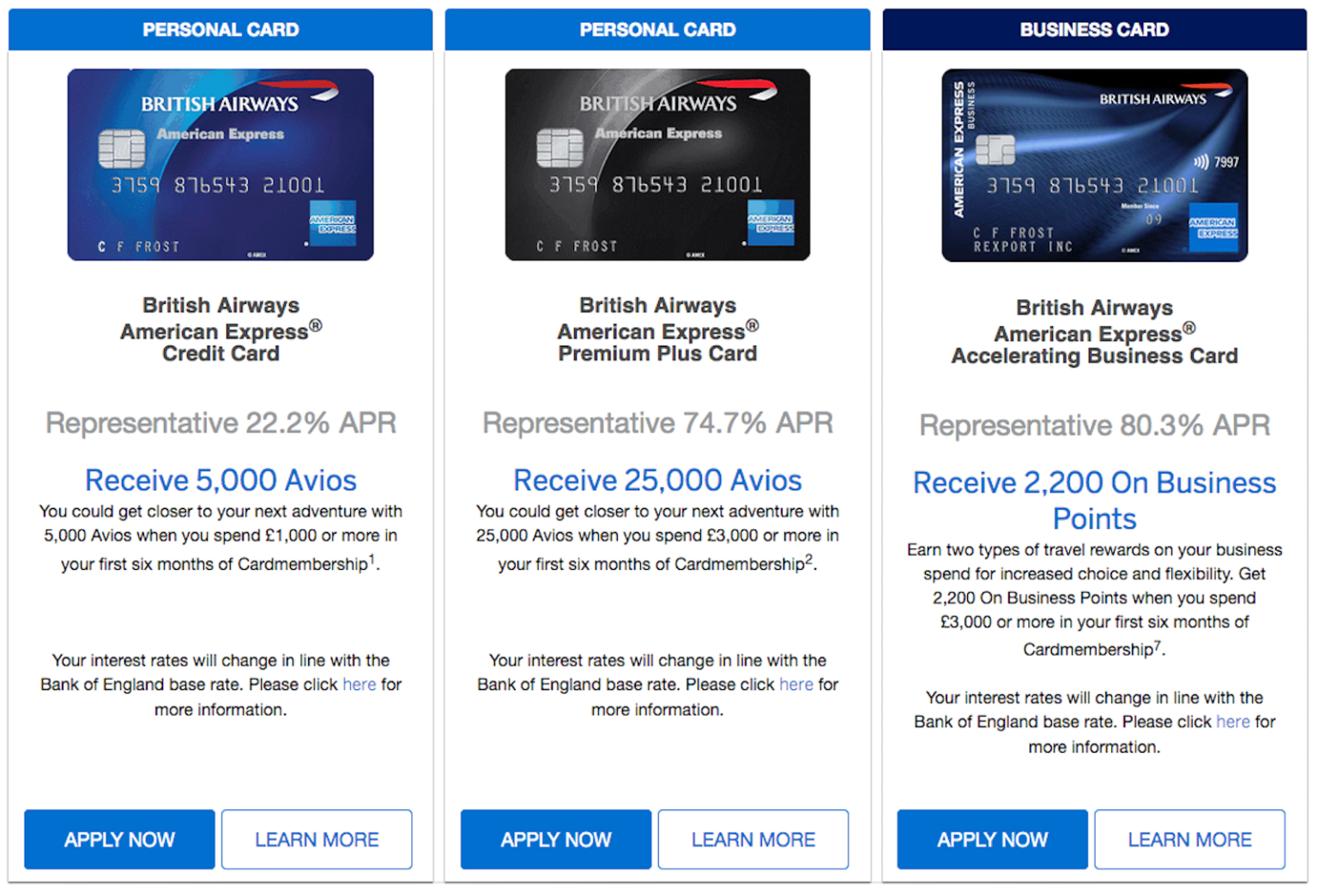

3pare lenders and provides

After you’ve gotten multiple preapproval also provides, it is the right time to examine prices to see which financial is the best option for you. The attention cost are important, however, so are other factors, like closing costs and fees.

Once you have picked a lender, it is the right time to start event the required documents add your own formal app and you can accomplish the fresh new HELOC. This https://paydayloancolorado.net/snyder/ could were past tax statements, current spend stubs, bank comments, and you will financial comments.

Loan providers usually think of many things to make certain you meet the underwriting requirements, like your money height, credit history, complete debt burden, current LTV, DTI, and a lot more.

5. Pertain and located your own personal line of credit

Now that you’ve all things in buy to suit your picked financial, you can please complete your application. The underwriting cluster often learn your details and, preferably, agree your new HELOC. Following, you might mark with the financing as required to spend off the education loan personal debt.

You’ll begin making money toward financial when you borrow funds. Monthly payments are calculated based on the actual amount borrowed. More and more you to lower than.

Just how to pay off your HELOC

HELOC repayments are similar to playing cards. You could potentially borrow on the brand new credit line as needed. Or even borrow money, you will not possess a payment per month. Of numerous HELOCs incorporate changeable rates, and this alter towards the business.

The monthly payments would-be interest-only during the draw period, that’s always five so you can 10 years. You can also create large money or repay the whole balance every month, if you prefer, to keep into the appeal will cost you.

From inside the draw months, you need your own HELOC because you look for complement, borrowing as much as the credit limit. Instance, if you’d like to create home improvements along with expenses off your student loans, you might.

Adopting the draw months stops, you go into the fees several months, that may last an alternative ten in order to 20 years. During this time, you will create typical monthly installments because you do for the any most other loan, until the equilibrium are paid back completely, and not draw from your own line of credit.

Finding HELOC loan providers to pay college loans

If you are pretty sure you could make costs for the HELOC and know it can save you cash in the future, this will be an audio monetary method worth considering.

Definitely research rates getting a great HELOC to discover the best deal. You should examine pricing, closing costs and other charge, the fresh new reputation of loan providers, and terms and conditions offered.

A good kick off point was the better HELOC loan providers & prices guide, and that dives into the all of our top options based on our very own article recommendations.