See the economic implications

After you’ve zeroed within the to the assets of your choosing, it is important to understand the fresh new completely stacked property rates. This really is a critical part during the planning this new monetary arrangements on get. There are have a tendency to hidden will set you back to your assets, which can be shared after. All of our useful publication can help you sit familiar with the complete questioned financial expenses.

Sign up for that loan

Trying to get that loan that have Family Very first is simple and you may convenient. Simply deliver the home loan data as the here, and we’ll be certain that hassle-free operating of your property loan application.

Borrowing from the bank assessment and financing sanction

House First commonly look at the candidate and you may co-applicants’ income, assets, liabilities, credit score, certificates, or any other points to buy the loan. And that,The new assessment can get encompass check outs to your house and you will work environment, as well as personal discussions with the candidate and you can co-applicants.

You are going to found an excellent approve letter in case your home loan recognition is successful. You must go back a finalized content of your approve letter to identify invited.

House First may approve around 90% of the home rates with regards to the borrowing from the bank appraisal. The balance matter, called downpayment, should be reduced from you right to this new creator.

The genuine portion of the loan approved and the down-payment will be given about sanction page. Once you’ve produced the new down payment on the creator, you ought to hand over a number of records in order to HomeFirst very that people is commence disbursal.

Build phase and you can pre-EMI attention payments

Inside the design phase, House Basic have a tendency to disburse loans towards builder in your stead. This is exactly in line with the fee demands produced by the newest builder, according to the construction plan.

Domestic First will only fees interest to your count disbursed just like the that loan when you look at the framework stage. Desire could be energized every month as well as the charging comments would be sent to your before the first of all of the month. Costs should be created before the fresh new next of your own following few days. I reference such attract repayments due to the fact pre-EMI focus repayments. EMI repayments will start merely immediately following end of endeavor and you can subscription of the house.

Registration, possession and you may EMI repayments

Once build is finished together with house is in a position to have palms, the newest marketing deed needs to be carried out and you will registered. So it assures the brand new transfer of ownership legal rights of the property of the fresh new builder with the buyer. Furthermore, the original sales action once registration needs to be handed over so you’re able to HomeFirst. This indicates the borrowed funds of the home with Domestic Earliest. This new marketing action can be carried out just following the complete believe towards assets could have been paid back towards the builder possibly owing to the brand new consumer’s how do i find out if my installment loans are legal in Arkansas own fund or financing.

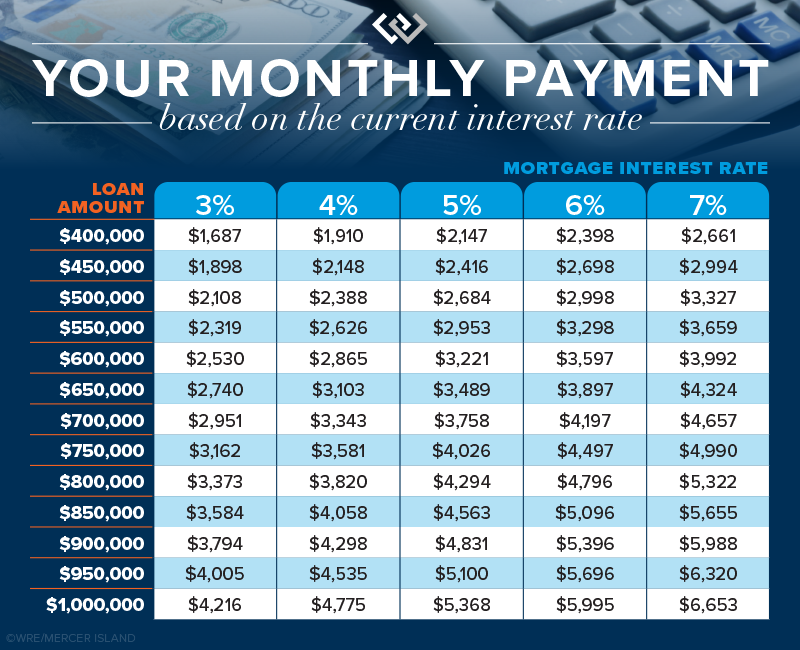

Installment of one’s mortgage because of Equated Monthly premiums (EMIs) begins throughout the next of the next week immediately following subscription. New EMIs can be as per the latest conditions governing your order as mentioned from the mortgage agreement. Is our very own EMI Calculator to find out the newest EMI payable for one mix of the mortgage matter, rate of interest, and you can period.

An electronic digital Cleaning Services (ECS) mandate (will be ACH), authorizing House Basic so you can debit your money towards the a designated go out getting percentage from EMIs, would-be compiled away from you.

Partial pre-payment: You can make a limited pre-fee which means that reduce your a great amount borrowed and you will attention outflow. Domestic Very first provides you with the option of-

1) Lowering your EMI proportionate towards the reduction in the mortgage count. However, the newest period will stay the same as their new period when you look at the including cases.

Complete pre-payment: You may also create a full pre-commission and repay the whole a fantastic mortgage. This will ensure that the loan try signed and also the financing agreement was ended. Post-closing away from financing, we shall go back all of the brand spanking new property data files collected within the loan acceptance techniques.

Assets and borrowing insurance

To guard oneself away from losings into the property from the flames and you will almost every other hazards, it’s always best to capture plans for your property. It will help recover one losses with the possessions from the feel regarding an enthusiastic untoward event. HomeFirst need you to definitely fill in a copy of one’s insurance coverage. All general insurance providers provide property insurance rates.

When the you will find questions otherwise doubts, delight get in contact with all of us. The audience is more happy to target questions otherwise assist.