Our very own quote form is free, easy-to-have fun with and you can and does not apply to your creditparing financial prices allows you to definitely find a very good mortgage terms and conditions

Family You can individuals are susceptible to money limitations. Quite simply, in case your gross income — that is your earnings ahead of deductions such as for example taxes and you can societal cover — try greater than the newest relevant debtor income restriction you are not qualified to receive the application. To help you qualify for a house You can easily loan, you cannot build more than 80% of area median earnings (AMI) to the census tract where in actuality the home is discover. Like, if your city average money where in fact the house we wish to money is located is actually $90,000, the individuals on the financial application you should never earn greater than $72,000 from inside the shared monthly gross income ($90,000 (AMI) * 80% = $72,000 (income restriction for this census region)). Freddie Mac’s Reasonable Income and Assets Eligibility Equipment allows you to determine the newest AMI and borrower money maximum having a location established towards property venue.

First-day homebuyers have to capture an effective Freddie Mac computer-recognized homeownership education category and buyers of multiple-product features have to just take a Freddie Mac-recognized property manager education category.

The applying is present to help you each other first-go out home buyers and you https://paydayloansalaska.net/homer/ may borrowers that used a house. At exactly the same time, House Possible system candidates are also allowed to own almost every other properties.

The house You are able to program doesn’t need consumers to hang coupons inside set aside in the mortgage closing for purchases from unmarried relatives characteristics, no matter if FREEandCLEAR recommends that you remain adequate offers in the reserve so you’re able to defense three-to-6 months of full monthly homes debts. To possess sales from multiple-family relations qualities consumers must hold a few months out of home loan repayments once the coupons in the reserve at home loan closing, whilst the requisite is generally large in many cases. So if your own month-to-month mortgage payment are $2,000, you will be expected to hold at the very least $cuatro,000 inside the put aside at the time the borrowed funds shuts.

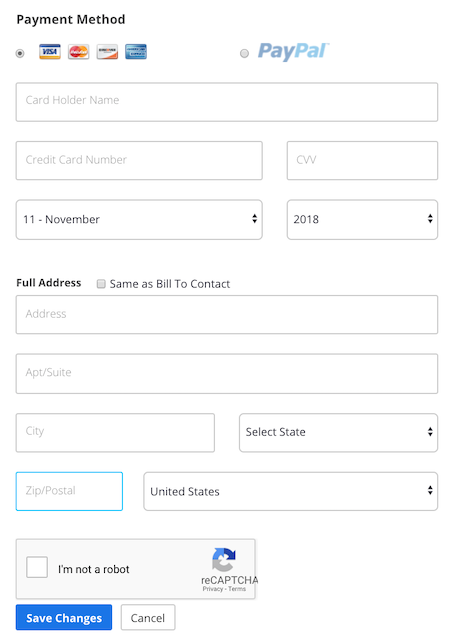

Get 100 % free Personalized Financial Quotes

The loan rates you only pay toward property You can easily loan is based for the several situations as well as your credit rating and you may mortgage-to-worth (LTV) proportion. Individuals having a credit history off 720 and over have the program’s most useful rates when you find yourself individuals having straight down fico scores and better LTV rates shell out high interest rates, which is a negative of the property You’ll System. Getting consumers that have a good credit score ratings, the mortgage rates to have a property You’ll be able to financing is like other traditional no and you may low down payment software but greater than the rate getting regulators-recognized apps for instance the FHA, Va and you may USDA mortgage apps. Borrowers would be to store multiple loan providers to find the Household You are able to mortgage to your best terminology.

You to definitely novel section of the home It is possible to system is that Freddie Mac computer limits the fresh new delivery costs it fees so you can lenders to possess individuals that have certain money profile or attributes situated in designated components. In a nutshell, capping birth charge means eligible borrowers is always to spend a lesser interest. New birth fee cap enforce when good borrower’s income are shorter than 80% of your urban area average income (AMI) or if the property is situated in a low income census region. You need to use Freddie Mac’s Sensible Earnings and you may Assets Qualifications Equipment to choose when you find yourself eligible for the reduced interest rate centered on your earnings top and you may possessions venue.

The home It is possible to Home loan System requires that individuals pick personal mortgage insurance (PMI), that is an ongoing month-to-month cost also your own monthly mortgage repayment. The amount of PMI the debtor is needed to shell out is based into LTV ratio, mortgage system and you will mortgage length, with the decrease your LTV ratio, the low the required PMI.