Exactly what bonuses would be the banking institutions giving to help you new clients plus exactly what things was these types of clawed right back basically decide to option bank after a while in the future?

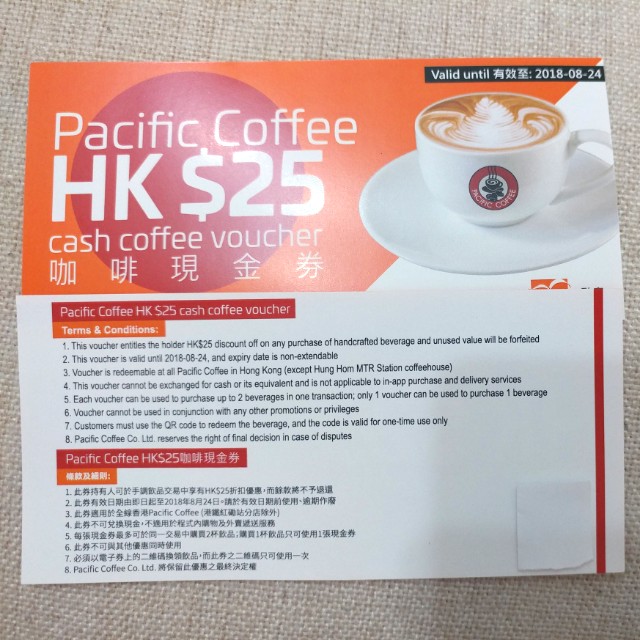

Certain lenders are currently giving (ount once the a cash back bonus. Thus instance having a mortgage regarding 3 hundred,000 you can aquire up to six,000 straight back. Yet not, we are going to constantly need a long term check whenever telling your on a home loan as future rate of interest can be more significant than initial bonuses.

Can i pay a lump sum from my personal home loan rather than punishment?

Generally, when you’re to the an adjustable mortgage, then sure you could. However, if you are towards the a fixed rates home loan, penalties can get use and it also varies from financial to help you bank, these penalties vary from financial to help you financial.

If you are on the a varying rate mortgage you could improve payment and we also can simply calculate the newest saving to you.

Do americash loans Ruby all lenders promote worry about-build mortgage loans and you can do all lenders have the same requirements?

Most lenders bring worry about-build mortgage loans, even though some do not. The conditions range from lender so you’re able to lender and we will indicates you to your most appropriate financial to suit your unique items.

What takes place in the event the my self create runs more than budget?

Lenders fundamentally generate for the contingency to fund people prices overruns, not since the for every single thinking-make instance is different we’re going to feedback costing towards engineer/architect in advance of distribution the applying. In the eventuality of an excellent unexpected more work with we are able to help you discuss on the lending company.

Will i score home financing basically have always been with the probation otherwise for the offer a position?

That it quite depends on your position, certification and you will employment records an such like. In addition it differs from financial to help you bank and we’ll advise your to the most suitable lender to you personally considering your very own novel situations.

Sure, you’ll get home financing to have escape homes. Some lenders apply a purchase to let price that’s basically 2% higher than the home financing cost, but it is you can easily locate home loan speed therefore will give you advice on same.

Can i keep my very own possessions and get a different sort of financial on the a separate property at the same time?

Yes, it is possible to maintain your own property susceptible to financing requirements, but not this might do tax factors and can even has actually an implications on your financial rate.

If the me otherwise somebody has actually a property otherwise a home loan already performs this effect on everything i can use?

Sure, it does, if one of you enjoys an existing family you will be limited by 80% of your own purchase price below Central Lender statutes. Yet not, the lenders are permitted particular discernment and it’ll definitely believe the potency of the job.

Often every lenders provide me personally an equivalent sum of money?

Since the introduction of Central Financial recommendations mortgage loans are capped from the 3.5 x salary. In principle the amount you are able to use can be an identical round the every lenders however in habit lenders is permitted to generate conditions from time to time. Nonetheless they eradicate additional money e.grams. overtime, added bonus, shift allocation, youngster work for an such like., in a different way so it is very much case by case.

What are the results if i have experienced arrears prior to now?

All loan providers and you can borrowing unions report to the latest Irish Borrowing Agency, plus the mortgage lenders usually accessibility it after you submit an application for a home loan. Yet not, when your arrears was indeed over couple of years ago this could not affect the job anyway. When you yourself have any issues in this region, delight contact us.