There can be a lot of conversation about the usually lowest pricing on conforming mortgages. If you are looking at a bigger home and want a great jumbo mortgage, even in the event, financial support is more problematic. Thankfully, debt remains offered at typically attractive membership. Freddie Mac and you will Federal national mortgage association are definitely the quasi-political agencies exactly who get mortgage loans in the usa and you will following resell…

Whether they is actually first-time buyers seeking to buy the best beginning house or long time homeowners wishing to refinance in check so you can protect less interest, Nothing Rock mortgage consumers have a large range of good possibilities to them. Before signing towards the dotted range, its smart to examine the support and you will pricing offered by Little Rock home loan providers, along with financial institutions, cred…

Mortgage Financial Speed Refinance – Getting a loan Mortgage Rate Refinance

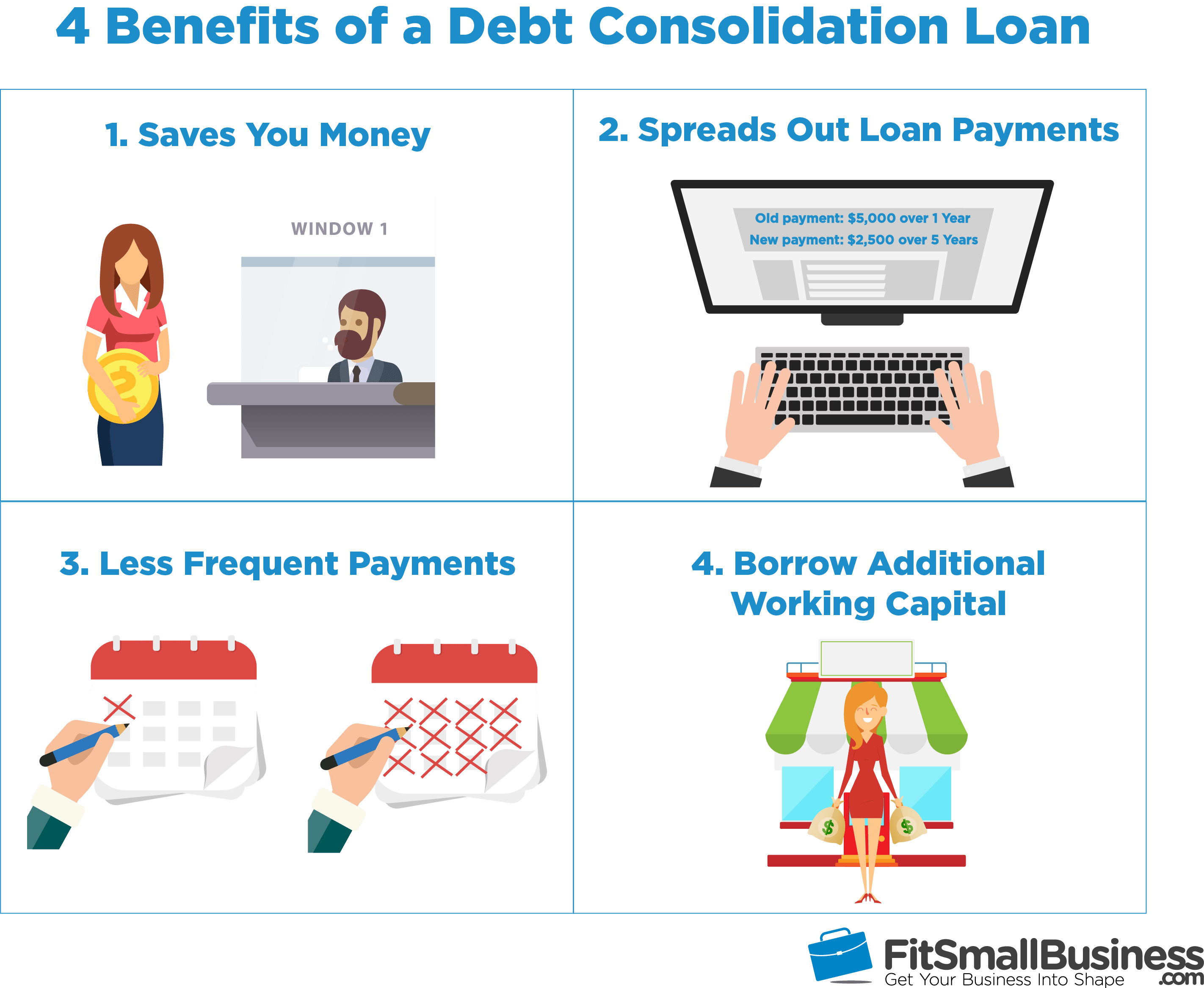

With financing interest levels within eg low levels now, people would like to get out-of the early in the day high appeal rates mortgages through getting the individuals finance refinanced within this type of lower costs. This really is beneficial not as much as specific standards. Whenever refinancing an existing home loan, consider all conditions and terms and view just what invisible charges otherwise charges could be used. Too high fees could make a beneficial particu…

Financing Having Poor credit – What are the Choices for Funds That have Poor credit?

The fresh new possibilities for those who have poor credit to locate fund was not what they was previously. Of several finance companies you to focused on taking financing to those which have poor credit provides either went out of business or was indeed absorbed because of the big companies that keeps stricter credit recommendations. The newest choices for people with bad credit to get the emergency money they need provides significantly diminished ov…

Low interest Family Equity Financing – Score a low-value interest Domestic Security Loan

The time has come to act if you have been considering with the security in your home to find loads of cash that have income tax experts and you will low interest. Score a low-value interest household guarantee loan or take care of upgrading the house, settling debts, strengthening an extension, attending college otherwise to purchase an automobile. Rates right now was as low as has been seen when you look at the years and you will a long way off regarding the highest intere…

Low interest rates Financial – How-to Be eligible for Low interest rates Financial

To purchase assets of your has long been felt an associate of one’s ?American Fantasy,? sufficient reason for house will cost you most less than these people were ten years back, buying a house could be more than a no-brainer. It can also be really affordable ? particularly if you be eligible for a low-value interest mortgage. With a low interest rate financial, so as to you need to use keep the price in your home low…

Low interest rate Financing – Getting Low interest rate Fund

Bundle in the future if you want to get funds which have low interest rates costs. That have a credit record will allow you to see also offers having borrowing at reasonable you are able to costs. Borrowing from the bank suggestions was an indicator to loan providers out-of how credit worthwhile one could be, based on previous credit history. Very legitimate loan providers offering funds carry out to consider borrowing from the bank background when someone applies for a loan. If they. loan places Pitkin..

Low rate Domestic Collateral Mortgage – That will Score a minimal Price Home Security Mortgage?

Low rate home collateral funds are an appealing monetary product available to property owners just who are obligated to pay lower than the value of their property. Owning a home has always been an effective financing and nothing says satisfaction than just with you to definitely home paid. not, because of the very high rates to your a property, few individuals own their houses downright. Mortgages loosen up to help you three decades in length, that makes ho…