Selecting a home which is perfectly to you personally can be like shopping for a beneficial needle during the a great haystack. Brand new home pay a visit to may possibly not be adequate, or these include too large. They may not be located in a handy city, otherwise these are typically within the a place that is too hectic otherwise noisy. The fresh new belongings your check may not have the fresh features you dream throughout the or need to have on the house.

Should your family appear was causing you to be cooler, you have still got alternatives. You to option is to create your next household from the crushed up in place of to acquire an existing home. Building a special home has many experts. You can choose the sort of our home, the quantity and type off rooms while the content utilized.

To shop for the fresh construction is somewhat unlike to buy a current domestic in a different way. The guidelines for loans and you may funding for brand new family framework commonly the same as he or she is for choosing belongings you to currently remain. Often, you’ll need to take out a property loan very first, that will become home financing once your family gets mainly based. When you’re bending for the building a new household, get everything into credit procedure.

Faq’s Regarding House Structure Money

Curious about the process of bringing a property loan? Your have in all probability particular issues. Let us address a few of the most commonly requested questions relating to delivering a home framework mortgage

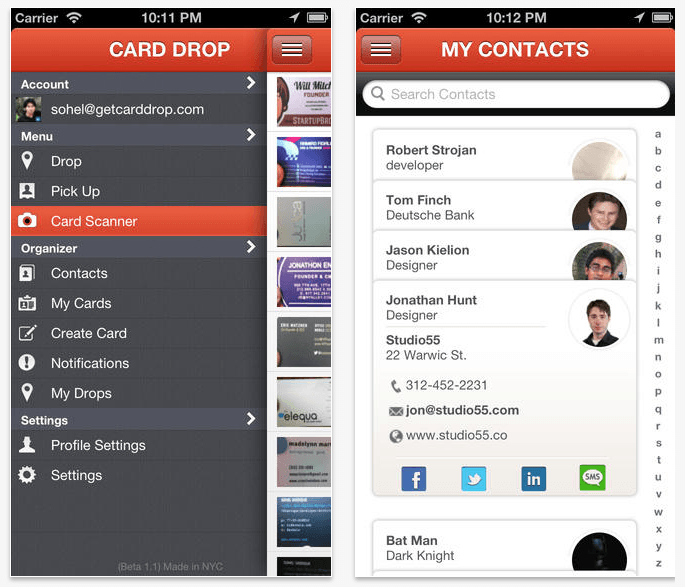

The process getting a property loan starts with an application. Very possible home builders apply at several organizations to see exactly what kinds of costs and you can financing terms and conditions are around for her or him. Since you pertain, possible render detailed framework project pointers, including the builder you may be dealing with, this building agreements and timeline, and you can will cost you out-of information and you may work.

Whenever acknowledged to the loan, this new debtor have a tendency to put a down payment, or if perhaps it currently individual new property, they may be able to utilize new guarantee within their property since the advance payment. The borrowed funds usually financing the construction, and you can commission is born in the event that investment is finished.

dos. Try a housing Loan home financing?

In the event a property loan pays for the price of building a great family, its technically maybe not a mortgage. A mortgage requires guarantee, in this situation, your house. When you find yourself building a property, there isn’t anything to act as security yet. Alternatively, a casing financing are a preliminary-term loan which you either pay-off immediately after in the event the opportunity is fully gone or move on the a mortgage.

step 3. What does a construction Mortgage Pay money for?

Framework finance pay money for every anything employed in building a different sort of house. New arises from the loan typically receive money towards company into the payments or while the specific building goals are hit. The bucks is safeguards the expense of permits, information and you will work. The mortgage may also buy this new belongings ordered to the household.

cuatro. What type of Credit rating How would you like?

Constantly, individuals should have a good credit score with a rating from during the least 680 in order to qualify for a property loan. The borrowing from the bank requirements can differ from the lender and you will mortgage system. Particular loan software let people with straight down credit ratings buy good brand new home that will getting a selection for you in case your get is on the reduced stop.

5. How much cash Might you Use?

Just how much you can use to create a different sort of house is based on the income, the size of the fresh new advance payment, and every other expense you really have. Loan providers will most likely not enable you to borrow if your brand new construction loan sets the debt-to-money ratio over forty five%. Put another way, the quantity you borrowed from 30 days, and book, charge card money, along with your the new design mortgage, really should not be more than forty five% away from that which you secure per month.